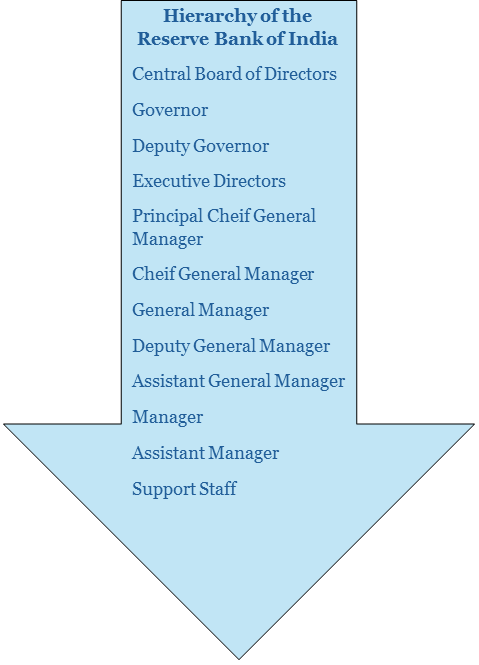

Every School has staff members like teachers, bus drivers etc. to perform the daily operations of the school. Then there is management that takes major decisions to form the rules, regulations and frameworks for the betterment of the school. Similarly in the RBI, the officers of various departments possess dedicated responsibilities but the major decisions of RBI as an organization were taken by the Central Board of Directors.

The RBI Central Board of Directors (CBD) is an apex body appointed by the Central Government under the provisions of the RBI Act, 1934. The establishment of CBD is to regulate the Reserve Bank of India. The board segregates specific functions to the local boards and various committees led by the governor of RBI.

Download the study material for free

Download PDFIn this blog, we will talk in depth about the Central Board of Directors of RBI. Make sure to read this blog till the end because this might help you in your RBI Grade B or RBI Assistant or any other RBI Exam. Let us start by knowing the hierarchy of the RBI.

Organizational Structure of the RBI

Members of the Central Board of Directors of RBI

As told you earlier that the CBD is the apex committee established by the Central Govt to look after all the major operations related to the RBI. Basically, the committee of the Central Board of Directors regulates RBI. There are a total of 21 members on that committee that includes official and non official directors. The members of the committee are a blend of the RBI officials, members of Ministry of Finance and the Local board members. Below is the breakdown of the 21 members of RBI’s central board of directors.

4 Directors representing the 4 Local Boards of the Reserve Bank of India (1 Director nominated by each of the 4 Local Boards – Mumbai, Kolkata, Chennai, and Delhi)

| Official Directors | Non Official Directors |

| The Governor of RBI | 10 Directors from various fields nominated by the Central Government |

| 4 Deputy Governors | 4 Directors representing the Local Boards of RBI |

| 2 Government Officials nominated by the Central Government |

You must be thinking about the Local Boards that I have mentioned above. There are 4 local boards of RBI spread across the country, i.e, Eastern, Western, Southern and Northern. Thus, the committee has one member from each local board here. The local boards are the zonal offices of RBI, i.e., Mumbai, Kolkata, Chennai and Delhi.

List of the Current Members in the Central Board of Directors in RBI

Currently there are 15 board members in the committee including 5 officials and 10 no official members. Below is the list of each of them:

| 5 Official Board Members | 10 Non Official Board Members |

| RBI Governor Shri Shaktikanta Das, 4 Deputy Governors of RBI Dr. M.D. Patra Shri M. Rajeshwar Rao Shri T. Rabi Sankar Shri Swaminathan J | Ms. Revathy Iyer Prof. Sachin Chaturvedi Shri Satish Kashinath Marathe Shri Swaminathan Gurumurthy Shri Anand Gopal Mahindra Shri Venu Srinivasan Shri Pankaj Ramanbhai Patel Dr. Ravindra H. Dholakia Shri Ajay Seth Dr. Vivek Joshi |

How do the Board Members get Appointed?

The board members are primarily appointed according to the provisions of the Reserve Bank of India Act 1934 by the Central Government. There is no prescribed list for the government to follow when deciding nominations to the Central Board. Part-time, non-official directors are chosen by the political executive, and the proposal for their appointment is moved by the Department of Financial Services under the Finance Ministry, needing approval from the Appointments Committee of the Cabinet (ACC). Generally, the government expects the RBI to consider the views of various stakeholders in the country’s socio-economic landscape, including businesses, cooperatives, self-help groups, academicians, and economists. Due to the RBI’s broader and apolitical role, the government usually avoids appointing individuals with strong ideological or political views. Although the government is not obliged to seek the Governor’s views or concurrence on its appointments, Finance Ministers conventionally discuss these appointments informally with the Governor before taking the proposal to the ACC.

Key Roles of the Central Board of Directors of RBI

The Members of the Committee meet every week to critically analyze the weekly Statistical bulletin of RBI. There are two major sub committees under the CBD headed by the RBI Governor.

Board of Financial Supervision (BFS)

- Includes deputy governors as ex-officio members and four other directors.

- Responsible for supervising banks, financial institutions, and Non-Banking Financial Companies (NBFCs).

Board of Payments and Settlements (BPS)

- Oversees both paper-based and electronic payment systems.

- Manages systems like NEFT (National Electronic Funds Transfer) and RTGS (Real-Time Gross Settlement) to ensure smooth and secure financial transactions.

Some other roles of the CBD comprise:

- Information Technology: Handles the technological infrastructure and security.

- Building Management: Takes care of the maintenance and operations of RBI buildings.

- Audit and Risk Management: Monitors financial auditing processes and manages risks.

- HR Management: Oversees human resources policies and employee-related matters.

General Mandates of the RBI Central Board of Directors

- Each committee member serves a tenure of 4 years at RBI.

- The Board is obliged to meet at least six times a financial year and at least once in every quarter.

- The board meets in with the Finance Minister in Delhi at least once after the presentation of budget in the parliament every year.

- The RBI Governor seeks suggestions form the board members for framing the regulations of amending them but the final decision maker is the RBI Governor only.

- All the Deputy Governors of RBI are allowed to attend any meeting of the board but are not entitled to vote.

Conclusion

An understanding of the structure and functioning of the RBI Central Board of Directors is important for those preparing for government competitive exams. This knowledge provides insight into the decision-making process and regulatory framework of the Reserve Bank of India. A board of government and non-government members plays a key role in formulating monetary policy, monitoring financial institutions and ensuring the efficiency of the payment system It breaks down the complex process into simple but critical steps which needs to emphasize the importance of each section, helps candidates prepare and enhance their understanding of RBI governance.

To help you prepare 50% faster for competitive exams, ixamBee provides free Mock Test Series and all the Current Affairs in English and Current Affairs in Hindi in the BeePedia capsules for GA Preparation. You can also get the latest updates for Bank PO, Bank Clerk, SSC, RBI Grade B, NABARD, and Other Government Jobs.

![List of Countries with their National Sports [Updated] List of Countries with their National Games](https://ixambee.com/blog/wp-content/uploads/2020/03/Yes-Bank-Moratorium-Know-In-Detail-6-100x70.png)