The Reserve Bank of India, which is also termed as Central Bank of India, is responsible for governing the monetary policy of the country. RBI was established on 1st April 1935 under the RBI Act, 1934 and was formed with the recommendation of the “HILTON-YOUNG Commission.” It was initially established as a privately owned bank and got nationalized on 1 January 1949 after the independence of India. RBI is headquartered in Mumbai, but initially, it was located in Kolkata and shifted to Mumbai in 1937.

What is the HILTON YOUNG Commission?

The Hilton Young Commission, also known as the Royal Commission on Indian Currency and Finance, was set up in 1926 to investigate the idea of bringing closer together the British territories in East and Central Africa. These regions were not very economically developed on their own, and the thought was that by working together, it could save money and help them grow faster.

Chaired by Sir Hilton Young, it was more than just a study of economic union. It had a broader scope. The Commission delved into various aspects of economic, fiscal, and monetary policies in the context of British India. It sought to find solutions to financial and currency challenges in the region. Its recommendations played a significant role in shaping economic and monetary policies, and they laid the groundwork for the establishment of the Reserve Bank of India (RBI) in 1935, a key institution that still regulates India’s currency and finances today.

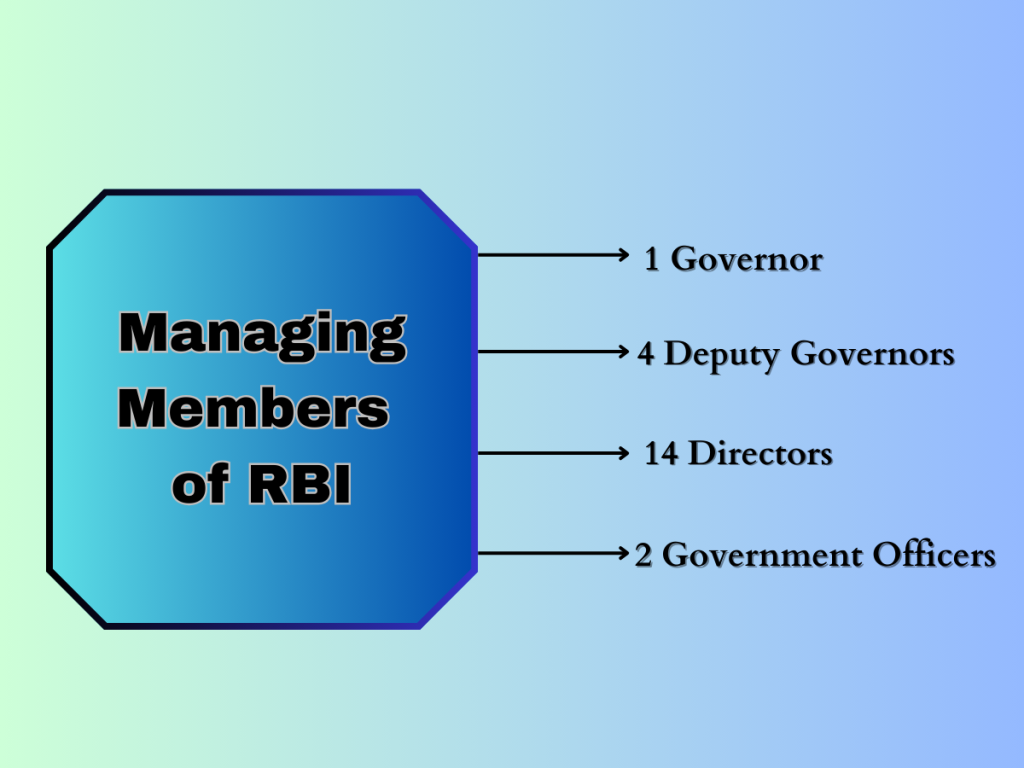

Managing Members of RBI

The Reserve Bank of India is headed by a team of members, including the governor. Here is the list of members who are responsible for making decisions in the RBI.

The present Governor of RBI is Shri Shaktikanta Das. He was appointed as the 25th RBI Governer on 12th December 2018 till 2021. In October 2021, he was reappointed as the Governor of RBI, and his tenure is still going on. Among the ten directors, four are nominated by the local board committee, whereas the rest of the ten members are appointed by the Government of India.

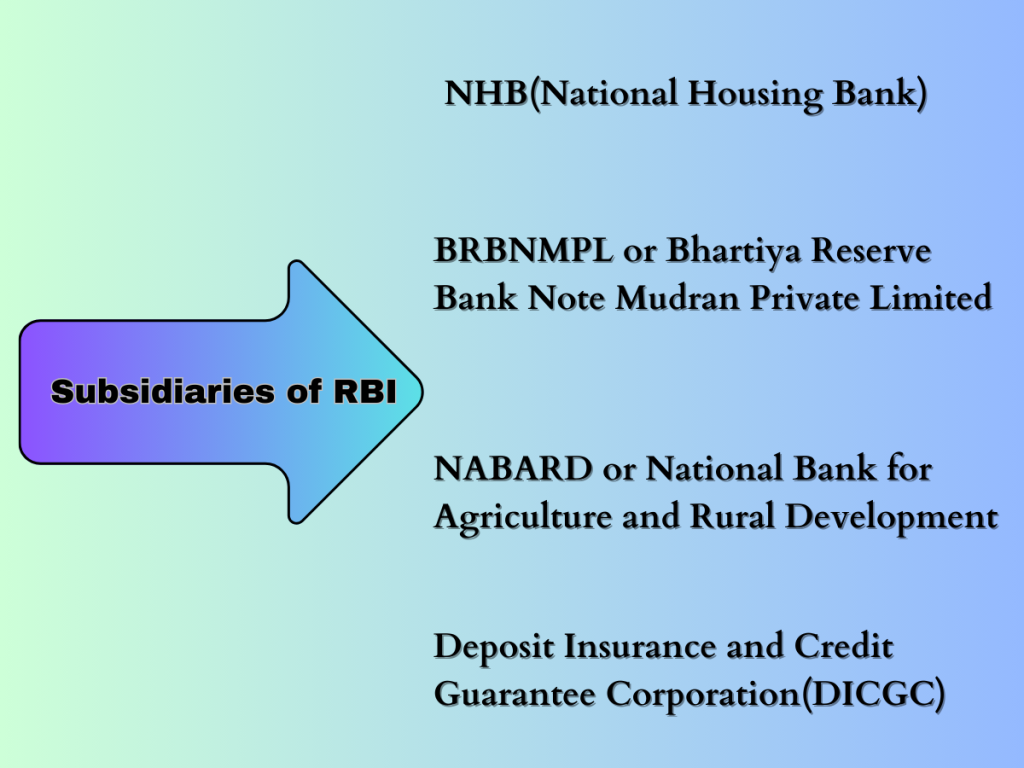

Subsidiaries of RBI

As you know, RBI is the essential pillar of creating monetary policies for the country. Thus, it has various subsidiaries that are dedicated to specific fields like Note Printing, Providing Loans, and ensuring deposits in Banks. Below are the subsidiaries of RBI responsible for fulfilling the functional objectives of RBI.

Functions of RBI:

- RBI issues the currency notes.

- It also acts as a Banker to the government.

- It holds cash reserves and foreign currency reserves.

- RBI is also known as the lender of last resort.

- RBI maintains a minimum reserve system of 200 crore rupees in the form of gold and foreign exchange reserves, out of which 115 crore rupees must be in the form of gold.

Who is an RBI Governor:

The Governor of RBI is the chief head of the Reserve Bank of India. He implements the policies of RBI to the benefit of the monetary status of the country. The status of the RBI governor is the same as that of a state minister.

Who can become a Governor?

Initially, RBI Governors were a part of Indian Civil services like C D Deshmukh, Bengal Rama Rao etc. But any individual who holds a Graduate degree/ Post Graduate/Chartered Accountant can become a Governor of RBI provided that he has worked in any of the following institutions:

- IMF/ World Bank.

- Chairman or General Manager of a Bank.

- Reputed Financial or Banking organization.

- Ministry of Finance (GOI)

Other than the above, any citizen who is 35 years or above than that is eligible. He must not be a member of the Parliament/State Legislature also, he/she must not hold any other office for profit.

Who appoints the Governor of RBI?

The Prime Minister’s Office (PMO) appoints the RBI Governor based on a recommendation from the Union Finance Minister and in line with the Reserve Bank of India Act, 1934. The Financial Sector Regulatory Appointment Search Committee (FSRASC) maintains a list of candidates for the RBI Governor position and conducts interviews. FSRASC members include the cabinet secretary, RBI governor, financial services secretary, and two independent members. The chosen candidate from these interviews is then sent to the Appointments Committee of the Cabinet, chaired by the prime minister, for final approval. Once the committee gives its approval, the appointment is confirmed.

Tenure of an RBI Governor:

An RBI Governor is appointed for three years and can exceed five years. However, it can be extended by the central Government whenever needed. There are some cases where the tenure of an RBI Governor can be terminated, and they are as follows:

- If dismissed by the President.

- Resignation is submitted by the Governor to the President.

Major things to know about RBI Governor

According to the RBI Act, the central bank must have four deputy governors. This includes two appointed from within the organization, one with a background in commercial banking and an economist to lead the monetary policy department.

The salaries and allowances of the governor and deputy governors can be set by the central board, subject to approval from the central government.

The Reserve Bank’s operations are overseen by a central board of directors, which is appointed by the Government of India in accordance with the Reserve Bank of India Act. The board of directors also includes the RBI Governor and at least four deputy governors.

Functions of the RBI Governor:

- Responsible to administer and monitor currency issuance.

- Responsible for issuing a license to new private banks and also to foreign banks in India.

- To ensure that the policy which is introduced by the RBI is implemented timely for the rural of society. Responsible for regulation and administration of the Indian financial system.

- Responsible for maintaining foreign exchange in India. Regulates and manages (FEMA) Foreign Exchange and Management Act 1999 Act.

Complete List of the RBI Governors of India

An RBI Governor is the head of RBI and is accountable for creating, amending, or abolishing any rule in the banking sector of India. The official tenure of an RBI Governor is three years, but many times, they got reappointed according to the requirements and their work experience. Below is the complete list of RBI Governers from the establishment of RBI till now.

| RBI Governor Name | Tenure |

| Osborne Smith | 1st t April 1935 to 30th June 1937 |

| James Brend Taylor | 1st July 1937 to 17th February 1943 |

| C. D. Deshmukh | 11th August 1943 to 30th June 1949 |

| Benegal Rama Rao | 1st July 1949 to 14th January 1957 |

| K. G. Ambegaonkar | 14th January 1957 to 28th February 1957 |

| H. V. R. Iyengar | 1st March 1957 to 28th February 1962 |

| P. C. Bhattacharya | 1st March 1962 to 30th June 1967 |

| L. K. Jha | 1st July 1967 to 3rd May 1970 |

| B. N. Adarkar | 4th May 1970 to 15th June 1970 |

| S. Jagannathan | 19th June 1970 to 19th May 1975 |

| N. C. Sen Gupta | 19th May 1975 to 19th August 1975 |

| K. R. Puri | 20th August 1975 to 2nd May 1977 |

| M. Narasimhan | 2nd May 1977 to 30th November 1977 |

| I.G. Patel | 1st December 1977 to 15th September 1982 |

| Manmohan Singh | 16th September 1982 to 14th January 1985 |

| Amitav Ghosh | 15th January 1985 to 4th February 1985 |

| R. N. Malhotra | 4th February 1985 to 22nd December 1990 |

| S. Venkatraman | 22nd December 1990 to 21st December 1992 |

| C. Rangarajan | 21st December 1992 to 21st December 1995 22nd December 1995 to 22nd November 1997 |

| Bimal Jalan | 22nd November 1997 to 5th September 2003 |

| Y. V. Reddy | 6th September 2003 to 5th September 2008 |

| D. Subbarao | 5th September 2008 to 4th September 2013 |

| Raghuram Rajan | 4th September 2013 to 4th September 2016 |

| Urjit Patel | 4th September 2016 to 11th December 2018 |

| Shaktikanta Das | 12th December 2018 onwards |

| Shaktikanta Das | Reappointed in December 2021 – Present |

You can easily rely on the above list of RBI Governors. This list is crucial to enhance your general awareness section for any upcoming Government exams. Curiosity is the key to a treasure of information. Therefore, we have come up with some interesting facts about the RBI Governors of India and their tenure. We are sure you are going to get the best from this blog. Here are some facts you should know about the RBI Governors of India.

Important Facts about the RBI Governor of India

- Dr. C. D Deshmukh was the first Indian Governor of RBI during the Independence of India. He served as an RBI Governor from August 1943 to June 1949.

- Dr. Manmohan Singh is the only RBI Governor till now who has also served as the Prime Minister of India.

- Y.V. Reddy was the RBI Governor during the 2008 financial crisis. He was given credit for the stabilization of the Indian economy during that time.

- Amitav Ghosh has been the RBI Governor for the shortest period of time, i.e., 20 days. He served as an RBI Governor from January 15 to February 4, 1985.

- RBI has never witnessed any women Governor since the time it was formed in 1935, but there was the first woman Deputy Governor, Ms. KJ Udeshi, from June 2003 till October 2005.

- Sir Benegal Rama Rau has served as an RBI Governor for the longest period of time. His tenure was from July 1949 till January 1957.

Being a Government job Aspirant, you should be well acquainted with the RBI Governors and relevant information about it. At ixamBee, you get it all, as we allow every student to get the best outcome from our resources. On the one hand, where we try to keep you updated with the right knowledge and information. On the other hand, we also believe that you should be accessible to the best resources anywhere and at any time. Therefore, we allow you to download current affairs for free on a daily, weekly, or monthly basis at your convenience.

Conclusion

In conclusion, the list of RBI Governors in India is not just a historical record but a valuable resource for aspirants preparing for government exams. General awareness about key institutions and their leadership is essential for success in these exams, as it demonstrates a sound understanding of the nation’s financial and economic systems. The RBI Governors have played pivotal roles in shaping India’s monetary policies and economic stability, making their tenure significant in the country’s history. Keeping abreast of such information is not just a matter of knowledge but a strategic advantage for those aspiring to serve the nation through government services. In today’s competitive world, where every detail matters, general awareness is the cornerstone of success.

Also Read:

Governors of States and Union Territories of India

Get Free Online Test Series, GK updates in form of Beepedia, as well as latest updates for Bank PO, Bank Clerk, SSC, RBI, NABARD and Other Government Jobs.

займ деньги онлайнонлайн займ на банковский счетзайм через контакт онлайн