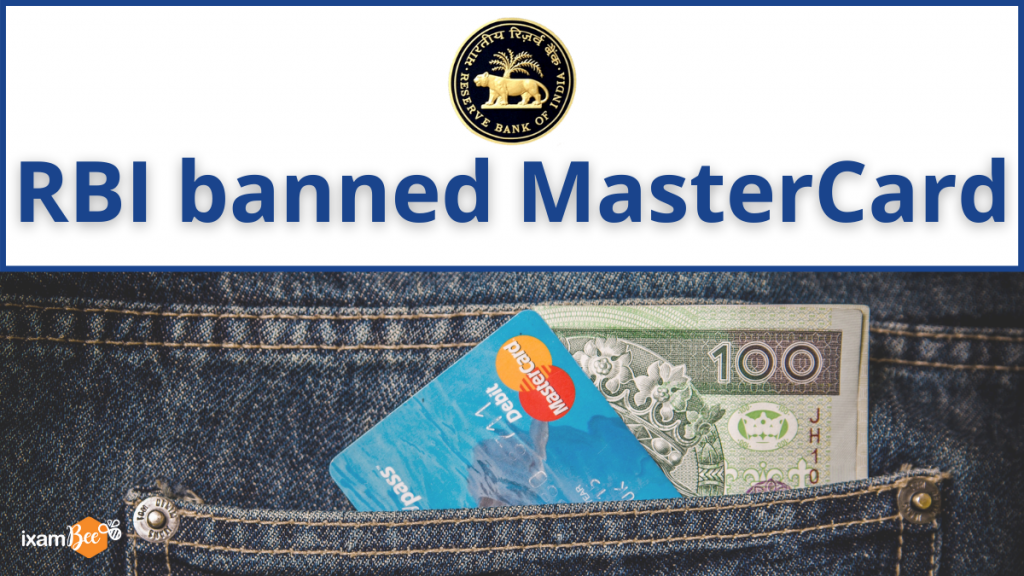

In a surprising turn of events on July 14, 2021, the Reserve Bank of India (RBI) dealt a significant blow to MasterCard, restricting the global payment giant from adding new customers within the Indian market. This restrictive measure, effective from July 22, 2021, marks a critical juncture in the relationship between MasterCard and the Indian regulatory landscape.

The crux lies in MasterCard’s failure to comply with the local data storage regulations laid down by the RBI in April 2018. With the ever-growing importance of data security and privacy, the central bank took a firm stance on enforcing these rules, and MasterCard found itself on the receiving end of regulatory action.

What makes this development even more noteworthy is the substantial market share that MasterCard commands in India, holding over one-third of the entire market. The implications of the ban ripple beyond MasterCard itself, extending to the numerous banks that have recently forged partnerships with the global payment giant as their card network provider.

This article delves into why the RBI took such a drastic step, examining its implications for MasterCard and the Indian banking sector. As the ban unfolds, the spotlight is on how this move will reverberate across financial institutions and what adjustments may be in store for the landscape of digital payments in India. Join us as we dissect the nuances of this regulatory decision and explore its far-reaching consequences.

RBI Ban on Mastercard: Possibilities

In the intricate landscape of India’s financial regulations, the Reserve Bank of India (RBI) wields significant authority, especially when it comes to payment systems. The Payment and Settlement Systems Act of 2007 (PSS Act) vests the RBI with the power to regulate and supervise payment systems within the country.

Under the PSS Act 2007 provisions, the RBI can take impactful measures, including restricting or banning entities like MasterCard. This authority is further solidified by two pivotal regulations: the Board for Regulation and Supervision of Payment and Settlement Systems Regulations, 2008, and the Payment and Settlement Systems Regulations, 2008. Both regulations, in tandem with the PSS Act, came into force on August 12, 2008.

Presently, India hosts three prominent card networks—MasterCard, VISA, and RuPay. Both MasterCard and VISA, originating from the United States, hold significant stakes in the Indian market. VISA, with a commanding market share exceeding 40 percent, and MasterCard, contributing more than 30 percent, play pivotal roles in shaping the country’s financial landscape.

This action by the Reserve Bank of India (RBI) isn’t the first instance of the regulatory body taking measures against a card network provider. Earlier, American Express and Diners Club faced similar restrictions as the RBI invoked its authority for non-compliance with local data storage regulations. The move highlights the RBI’s commitment to enforcing stringent standards within the payment ecosystem, ensuring the adherence of global players to India’s regulatory framework. As the Indian card network dynamics undergo transformative shifts, the implications of such regulatory actions ripple through the financial sector, prompting a closer look at the evolving relationship between international card networks and the regulatory landscape in India.

RBI’s Solution to the Situation

In a significant move to fortify safety and security measures within the Indian financial landscape, the RBI issued a circular on April 5, 2021. The circular mandated that all system providers enforce the storage of entire data related to payment systems exclusively within the borders of India. This crucial directive applies to a spectrum of transaction data, encompassing comprehensive end-to-end details and information integral to messages and payment instructions. By enforcing this data localization requirement, the RBI aims to bolster the resilience of payment systems against potential security threats and ensure a robust framework for protecting sensitive financial information.

This strategic measure reflects the central bank’s commitment to enhancing data security and aligning the operations of payment system providers with the stringent regulatory standards outlined in India. The RBI’s ban on MasterCard, adequate only for adding new customers, will not impact existing account holders. Existing MasterCard customers will continue to operate without disruption or service changes. According to the RBI, with a staggering count of 90.23 crore debit cards and 623 crore credit cards issued in India, the recent ban on MasterCard for new customer additions will not affect the multitude of existing cardholders across the country.

RBI’s MasterCard Ban: Regulatory Measures

The Reserve Bank of India (RBI) oversees monumental card issuance in India, with 90.23 crore debit cards and 623 crore credit cards. Despite this, a recent RBI ban on MasterCard for new customers won’t affect existing cardholders. This regulatory move aligns with data localization rules, reflecting the RBI’s commitment to financial data security while maintaining continuity for millions of nationwide card users. Take a look at some observations in this regard:

- Existing Cardholder Continuity: Despite the regulatory ban targeting new customer onboarding for MasterCard, existing cardholders, including the vast 90.23 crore debit cardholders and 623 crore credit cardholders, experience no disruptions in their day-to-day transactions. This continuity reflects a thoughtful approach to regulation, balancing the imperative of heightened security measures without causing inconvenience to millions of users already accustomed to card-based transactions.

- Safeguarding Financial Data: The ban on MasterCard aligns with the RBI’s commitment to robust financial data security. This strategic move underscores the central bank’s dedication to enforcing compliance with data localization rules, ensuring that payment systems adhere to stringent regulatory standards. By safeguarding sensitive information, the RBI aims to create a secure environment for the growing number of individuals relying on card-based transactions in the dynamic landscape of India’s financial sector.

- MasterCard and Compliance: The recent ban on MasterCard for new customer additions is a strategic regulatory action by the RBI to enforce compliance with data localization rules. This move is part of the RBI’s broader initiative to enhance cybersecurity measures within the financial ecosystem, ensuring that all payment systems operating in India adhere to stringent data protection protocols.

RBI’s Withdrawal of MasterCard Ban

In a turn of events, the Reserve Bank of India (RBI) announced the withdrawal of the ban imposed on MasterCard for new customer additions in 2022. This regulatory update comes after extensive discussions and assessments, signaling a resolution to the compliance issues that led to the initial ban. The RBI’s decision reflects a collaborative effort between regulatory authorities and MasterCard to address concerns related to data localization rules.

This withdrawal is expected to relieve MasterCard and financial institutions that rely on its services, fostering a renewed sense of stability and continuity within the Indian financial landscape. As the ban lifts, it underscores the importance of dialogue and cooperation between regulatory bodies and global payment networks in navigating the complexities of data security and compliance in an ever-evolving digital economy. Anyone looking for a career in the RBI must be aware of the changes in these regulatory measures. Those considering a career with the RBI can seek assistance from ixambee’s intricate RBI Online Courses.

Prepare with ixamBee for RBI Grade B Exam 2024

If you are among the many aspiring candidates preparing for a dream career with the RBI, you know that getting into the esteemed organization can occur only after you clear the recruitment process. The first step in the recruitment process is clearing the preliminary and the main exams before you clear the interview. Aspiring candidates should be aware that current affairs and all the news updates related to economics, finance, banking, and new laws implemented by the RBI are news bites you need to be well aware of, especially for the exams and the interview process with the RBI. This is especially required since the recruitment exams include the General Awareness section. Aspiring candidates preparing for the recruitment process can utilize the resources provided by ixambee, including the RBI Exam Pages, RBI Mock Tests, and Previous Year Papers.

Summing Up

The saga of the RBI’s ban on MasterCard, its regulatory journey, and eventual withdrawal showcases the intricate dance between data security, compliance, and the ever-evolving digital landscape. The collaborative efforts between regulatory bodies and global payment networks highlight the importance of adaptability. As the ban lifts, it signifies a renewed era of stability and continuity, emphasizing the pivotal role of ongoing dialogue in shaping India’s financial future.

To help you prepare 50% faster for competitive exams, ixamBee provides a free Mock Test Series and all the Current Affairs in English and Current Affairs in Hindi in the BeePedia capsules for GA Preparation. You can also get the latest updates for Bank PO, Bank Clerk, SSC, RBI Grade B, NABARD, and Other Government Jobs.

Also Read

Current Affairs Preparation for RBI Grade B Exam

New Question Patterns for RBI Grade B

RBI Assistant Exam Phase 1 Exam Analysis

Informative content. Kudos to ixambee? keep it up.