Start learning 50% faster. Sign in now

Under the written down value (WDV) method of depreciation, the WDV of the asset is always more than zero. The WDV of an asset is the value of the asset after deducting the accumulated depreciation from its original cost. Under the WDV method, depreciation is charged at a fixed percentage on the WDV of the asset each year, which means that the WDV will decrease each year. However, the WDV can never be zero or less than zero because the asset still has some value, even if it has been fully depreciated.

Select the correct mirror image of the given figure when the mirror is placed at MN as shown below.

If ‘<’ means ‘−’, ‘!’ means ‘×’, ‘>’ means ‘+’ and ‘$’ means ‘÷’, then what is the value of the following expression...

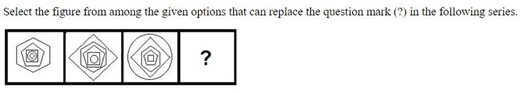

Identify the figure that completes the pattern.

Four persons are painting a house. M is painting the front of the house. R is in the street behind the house painting the back. J is painting the window...

A paper is folded and cut as shown below. How will it appear when unfolded?

In a certain code language " BRIEF" Is written as " SCHOF" , and " CHART " is written as "IDZUS". Which of the following are correct matches as ...

In a certain code language, 'GATE' is written as 'JOFB' and 'IDLE' is written as 'JGID'. How will 'MILK' be written in that language?

Shilps and Radhika started walking from two different points, 'A' and 'B', respectively. Shilpa walks 4 km North, turns to the East and walks 6 km, agai...

Which letter-cluster will replace the question mark (?) to complete the given series?

AXFN, GCJQ, MHNT, ?, YRVZ