Question

What is the primary objective of the PM Vishwakarma

scheme?Solution

Explanation: A new Central Sector Scheme “PM Vishwakarma” with a financial outlay of Rs.13,000 crore for a period of five years (FY 2023-24 to FY 2027-28). The scheme aims to strengthen and nurture the Guru-Shishya parampara or family-based practice of traditional skills by artisans and craftspeople working with their hands and tools. The scheme also aims at improving the quality, as well as the reach of products and services of artisans and craftspeople and to ensure that the Vishwakarmas are integrated with the domestic and global value chains. Under PM Vishwakarma scheme, the artisans and craftspeople will be provided recognition through PM Vishwakarma certificate and ID card, Credit Support up to Rs.1 lakh (First Tranche) and Rs.2 lakh (Second Tranche) with a concessional interest rate of 5%. The Scheme will further provide Skill Upgradation, Toolkit Incentive, and Incentive for Digital Transactions and Marketing Support.

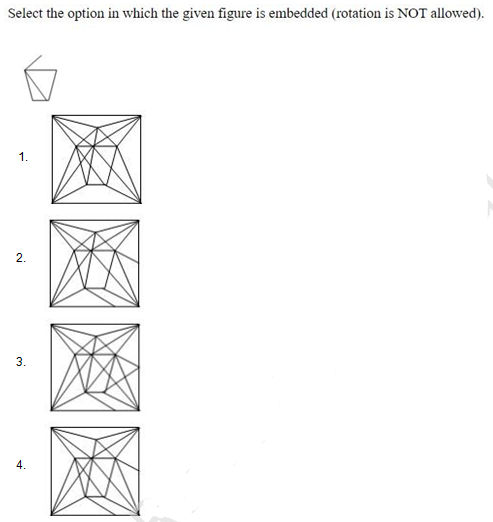

- Select the option in which the given figure is embedded (rotation is not allowed).

Select the option in which figure is embedded.

From the given answer figures, select the one in which the question figure is hidden / embedded(rotation is not allowed).

Select the option in which the given figure is embedded.

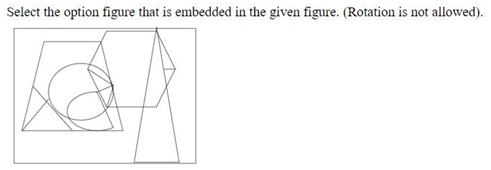

Select the option that is embedded in the given figure: (Rotation is not allowed).

Select the option in which the given figure is embedded (rotation is not allowed).

Select the option figure that is embedded in the given figure (rotation is Not allowed).

In the question, assuming the given statements to be true, find which of the conclusion (s) among given two conclusions is /are definitely true and the...

Relevant for Exams: