Start learning 50% faster. Sign in now

“The July 1 implementation of the Goods and Services Tax and the steps taken to address the twin balance sheet problem in the banking sector. The latter includes the push to use the Insolvency and Bankruptcy Code for debt resolution and the initiative to recapitalize public sector banks.”

Which gas is primarily emitted from rice fields?

What is the Capacity of High-volume sprayer?

A typical godown consisting of 3 compartments, having a span of 21.7 m and height of 5.4 m has a capacity of

Which of the following Nitrogen Fertilizer is partly soluble?

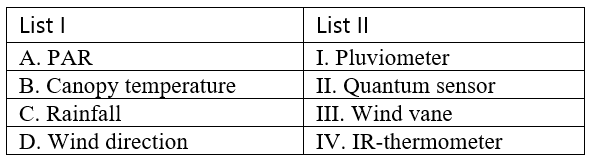

Match List I with list II

MB plough, for tractor pull can work in per day (2 bottom)?

The scientific name of grass carp is…………………………..

The crop that is used for the production of both oil and fiber is called ____.

Ozone layer is situated in which atmospheric layer?