Question

RBI has proposed to extend the BASEL-III Capital

regulations to All India Financial Institutions (AIFIs) and minimum total capital against risk-weighted requirements for the same is:Solution

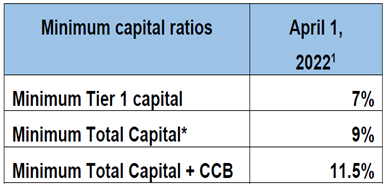

For NHB (National Housing Bank) Since the accounting year is July-June, the implementation shall commence on July 1, 2022. AIFIs are required to maintain a minimum Pillar 1 Capital to Risk-weighted Assets Ratio (CRAR) of 9% on an on-going basis (other than capital conservation buffer and countercyclical capital buffer etc.). These institutions should have minimum total capital at nine per cent from 1 April 2022 along with minimum capital buffer at 2.5 per cent, the central bank has recommended. Minimum common equity tier 1 (CET1) capital would be 5.5 per cent while minimum tier one capital requirement is proposed at seven per cent.

For NHB (National Housing Bank) Since the accounting year is July-June, the implementation shall commence on July 1, 2022. AIFIs are required to maintain a minimum Pillar 1 Capital to Risk-weighted Assets Ratio (CRAR) of 9% on an on-going basis (other than capital conservation buffer and countercyclical capital buffer etc.). These institutions should have minimum total capital at nine per cent from 1 April 2022 along with minimum capital buffer at 2.5 per cent, the central bank has recommended. Minimum common equity tier 1 (CET1) capital would be 5.5 per cent while minimum tier one capital requirement is proposed at seven per cent.

In terms of the order from youngest to the oldest soil, which one of the following is the correct chronological sequence?

Which of the following parameter is not included in the Soil health card?

For the farmers, ………………………………. Soil structure is favourable for plant growth.

...The acidic soils can be reclaimed by the application of ____

Which metamorphic rock is formed from the alteration of shale?

The Indian seed act was passed in the year

The term “operational holding” refers to

Which property of soil usually reflects the extent of leaching and weathering of soils?

Which type of layer silicate clay minerals demonstrates a structure comprising two silica tetrahedral sheets and two magnesium-dominated tri-octahedral ...

The saline soils contain toxic concentration of soluble salts in the root zone. These saline soils are also known as…………...

Relevant for Exams: