Start learning 50% faster. Sign in now

The introduction of Risk-Based Internal Audit (RBIA) system was mandated for all Scheduled Commercial Banks (except Regional Rural Banks. It was decided later to mandate RBIA framework for the following Non-Banking Financial Companies (NBFCs) and Primary (Urban) Co-operative Banks (UCBs): All deposit taking NBFCs, irrespective of their size; All Non-deposit taking NBFCs (including Core Investment Companies) with asset size of ₹5,000 crore and above; and All UCBs having asset size of ₹500 crore and above.

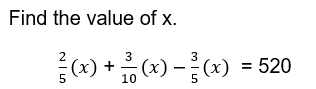

Solve the following:

523 + 523 x 523 ÷ 523

1300% of 2341 + 1200% of 6321 = ?

20% of (√9216 + ?) = 24

√0.49 + √6.25 + √1.44 + √1.21 =? % of 125

(25 × 12 + 30 × 8 – 22 × 10) = ?

√3970 × √730- √2400 =?

31% of 3300 +659 = ?

?2 = (1035 ÷ 23) × (1080 ÷ 24)