Start learning 50% faster. Sign in now

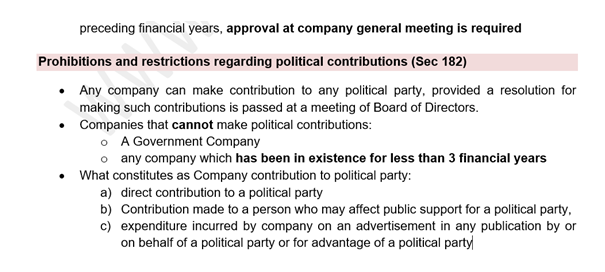

Section 182 – Prohibitions and restrictions regarding political contributions (1) Notwithstanding anything contained in any other provision of this Act, acompany, other than aGovernment companyand a company which has been in existence for less than threefinancial year, may contribute any amount directly or indirectly to any political party: Provided that no such contribution shall be made by a company unless aresolution authorising the making of such contribution is passed at a meeting of theBoard of Directorsand such resolution shall, subject to the other provisions of this section, be deemed to be justification in law for the making of the contribution authorised by it. Snapshot from study notes of the ixamBee SEBI course covering topic in crisp and easy to remember format Also same Question covered in revision Questions for Companies Act

What is the allocated amount for skill development, employment, and education to support MSME growth in India as per Union Budget 2024-25?

A setup in which group of individuals or entities decides to pool resources towards fulfilling a debt or financing a single borrower wherein the setup i...

With reference to Millets, consider the following statements:

1. The United Nations General Assembly, in its 75th session during March 2...

Which of the following is/are true about the Sub-Prime Crisis?

1) It is a mortgage crisis referring to credit default by the borrowers.

<...Current ratio is 4:1. Net Working Capital is Rs.30,000. Find the amount of current Assets.

Which term describes the percentage of each sales rupee that remains after a company has paid for its goods?

What does the two way rates quoted as 1$=82.10/11 ₹, mean?

Which financial ratio is used to assess a company’s ability to cover its short-term liabilities using only its most liquid assets?

Which company partnered with Airtel Payments Bank to offer UPI Switch, aiming to manage UPI transactions on the bank's platform?

Which nation is being aided by the Indian government to combat locusts, including the supply of 40,000 liters of Malathion, an environmentally friendly ...