Start learning 50% faster. Sign in now

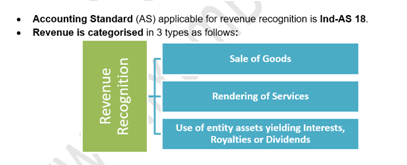

Ind AS 18 delas with revenue recognition. The revenue considered under Ind AS 18 is revenue from sale of goods, rendering of services and use of entity assets yielding interests, royalties or dividend. Snapshot from study notes of the ixamBee SEBI course covering topic in detail

Abdulla Yameen, has been sentenced to 11 years in prison and fined $5 million in case of corruption and money laundering. He was the former President of...

What was launched on April 29, 2024, at M/s Suryadipta Project Pvt. Ltd.?

Five of the top-10 most-valued firms added Rs 1,99,111.06 crore in market valuation last week, with Reliance Industries emerging as the biggest gainer. ...

What is the primary aim of the National Quantum Mission?

Under the Income Tax Act, 1961, which category of investors will not be taxed on their income from offshore investments made through an Alternative Inve...

Which new feature did NPCI introduce to allow delegation of payment responsibilities on UPI?

Under the Namo Drone Didi Scheme, what percentage of the drone cost is subsidized, and what is the maximum subsidy amount available per drone?

Integrated energy company NTPC has begun trials of an intra-city hydrogen bus operation in Leh on a trial basis. NTPC aims to achieve 60 GW of renewab...

What is the main objective of KYC guidelines followed by Banks?

I- It helps prevent banks from using criminal networks.

II- KYC helps the ...

The governments of ____& _____ have signed an agreement for the settlement of an inter-state boundary dispute between the two States which will end the ...