Question

A company shall not, at any time, vary the terms of a

contract referred to in the prospectus or objects for which the prospectus was issued, except subject to the approval of, or except subject to an authority given by the company in ________ by way of __________.Solution

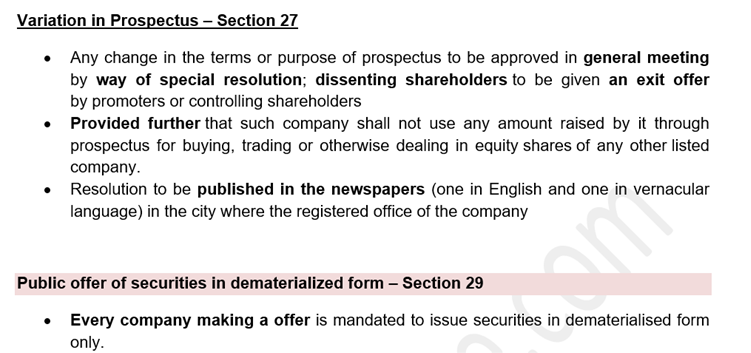

Section 27 of Companies Act 2013: Variation in terms of contract or objects in prospectus (1) A company shall not, at any time, vary the terms of a contract referred to in the prospectus or objects for which the prospectus was issued, except subject to the approval of, or except subject to an authority given by the company in general meeting by way of special resolution : Provided that the details, as may be prescribed, of the notice in respect of such resolution to shareholders, shall also be published in the newspapers (one in English and one in vernacular language) in the city where the registered office of the company is situated clearly indicating the justification for such variation: Provided further that such company shall not use any amount raised by it through prospectus for buying, trading or otherwise dealing in equity shares of any other listed company. (2) The dissenting shareholders being those shareholders who have not agreed to the proposal to vary the terms of contracts or objects referred to in the prospectus, shall be given an exit offer by promoters or controlling shareholders at such exit price, and in such manner and conditions as may be specified by the Securities and Exchange Board by making regulations in this behalf. Snapshot from study notes of the ixamBee SEBI course covering topic in crisp and easy to remember format

______ supresses branching and promote rhizosphere interactions.

_______ is the concept under which a company carefully integrates and coordinates its many communications channels to deliver a clear, consistent, and c...

Insects exhibiting complex social behavior with division of labor and cooperative brood care belong to which group?

Toxicity of which element leads to the unavailability of iron and zinc

The fruit of mustard is called

The recently formed order with little profile development is termed as ………………………..

Which insect is considered one of the most important disease vectors among humans and why?

Water logging in soil favors production of

The aromatic plant used to provide delicate fragrance for floral decoration, bouquets is

Most expensive spice in the world is