Question

When producer bears the cost of tax, what is the impact

on elasticity of demand and supply?Solution

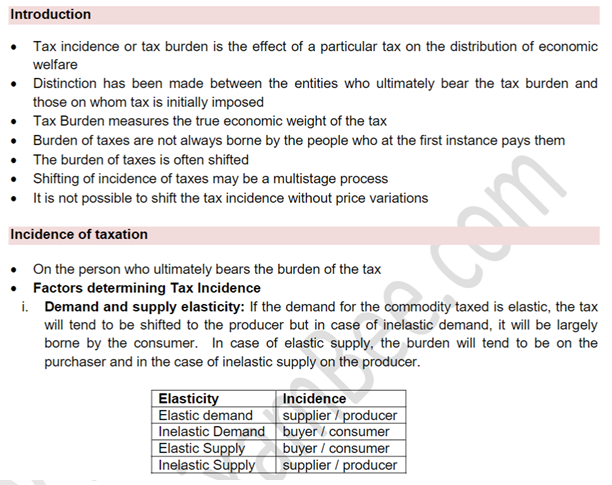

If the demand for the commodity taxed is elastic, the tax will tend to be shifted to the producer but in case of inelastic demand, it will be largely borne by the consumer. In case of elastic supply, the burden will tend to be on the purchaser and in the case of inelastic supply on the producer. Covered in videos and study notes; snapshot from study notes of the ixamBee SEBI course

Who is the author of the historical fiction novel ‘The Mauryan: The Legend of Ashoka’?

Which of the following is a non-conventional source of energy?

As of July 2023, how many products were notified under the 'One District, One Product' scheme as per the information provided by the Ministry of Food Pr...

Amnesty International is an organization which is associated with

Infosys, Indian IT services company, announced a multi-year partnership with which women's tennis player?

Consider the following statements in relation to SEBI guidelines?

1. “Defaulter” means an entity against whom recovery proceedings are...

The Is of Doing Business Report does not determine the regulators who affect __________.

Where was Azad Hind Fauj (INA) formed?

Any question relating to disablement shall be determined by which one of the following authorities under the Employees' State Insurance Act, 1948?

Indian Olympic Association (IOA) was formed in the year ______.