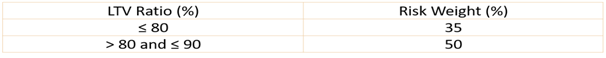

Question

What is the risk weight for the housing loans with LTV

Ratio (Loan to Value Ratio) lesser than 80%?Solution

In October 2020, the risk weights for all new housing loans from October 16, 2020 and up to March 31, 2022 were rationalized, as a countercyclical measure, irrespective of the amount of loan. These risk weights will continue for all new housing loans to be sanctioned up to March 31, 2023 as follows:  Loan to Value Ratio is the amount of loan that can be given as a percentage of the market value of a property, which is valued by an empaneled independent valuer identified by the Bank. For eg: if the market value of the property is 80 lakhs, then the maximum loan that can be given is (if LTV Ratio of the bank is 80%) 64 lakhs (80% of 80 lakhs). Other things like income of the applicant will also be considered to decide the final loan eligibility

Loan to Value Ratio is the amount of loan that can be given as a percentage of the market value of a property, which is valued by an empaneled independent valuer identified by the Bank. For eg: if the market value of the property is 80 lakhs, then the maximum loan that can be given is (if LTV Ratio of the bank is 80%) 64 lakhs (80% of 80 lakhs). Other things like income of the applicant will also be considered to decide the final loan eligibility

Bhawna won 3/5 of the marbles that were there at the beginning of the game. Ravi won 2/3 of the remaining marbles while Sunny won the remaining 80 marbl...

If 94*6714 is divisible by 11, where * is a digit, then * is equal to

What should come in place of the question mark (?) in the following question?

956 × 753 = ?

What is the average of all the prime numbers which are less than 35?

There are three numbers 'a', 'b' and 'c' (a < b < c) such that 'b' is equal to the average of 'a' and 'c'. 70% of 'c' is equal to 'a' and the difference...

Determine the smallest possible value of 'P' that makes the eight-digit number '4423P456' fully divisible by 3.

Priya has joined Twitter and has 8 friends and each of these friends has 12 friends. Later, it is found that at least two of her friends know each othe...

When a number is increased by 60% then the number obtained is 56 less than thrice the original number. Find the original number.

Relevant for Exams: