Start learning 50% faster. Sign in now

The "Risk Management and Inter-Bank Dealings – Hedging of Foreign Exchange Risk" circular states that users are required to adjust their hedge if the exposure ceases to exist, but there is no specific requirement for liquidation within 30 days regardless of market conditions. Instead, adjustments depend on the nature and timing of the exposure change.

If tan θ + cot θ = 5, find the value of tan²θ + cot²θ.

What is the value of cos [(180 – θ)/2] cos [(180 – 9θ)/2] + sin [(180 – 3θ)/2] sin [(180 – 13θ)/2]?

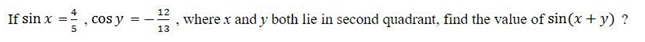

If sin A = 3/5 and cos B = 4/5, where A and B are acute angles, find the value of sin(A + B).

If cos²α + cos²β = 2, then the value of tan⁴α + sin⁸β is

From a point 50 meters away from the base of a tower, the angle of elevation of the top of the tower is 30°. Find the height of the tower.

If cos² x + sin x = 5/4, then find the value of 'sin x'.

The minimum value of 77 sin θ + 36cosθ is

What is the value of [(sin x + sin y) (sin x – sin y)]/[(cosx + cosy) (cosy – cosx)]?