Question

The Basel III norms have prescribed a Leverage ratio of

a) ___% while the Reserve Bank of India has prescribed a leverage ratio of b)___% for D-SIBs and c)___% for other banks.Solution

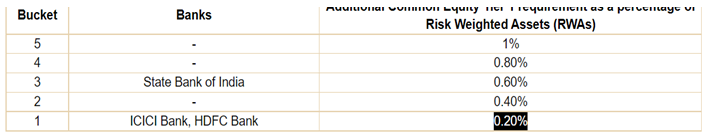

Some banks, due to their size, cross-jurisdictional activities, complexity, lack of substitutability and interconnectedness, become systemically important. The disorderly failure of these banks has the potential to cause significant disruption to the essential services they provide to the banking system, and in turn, to the overall economic activity. Therefore, the continued functioning of Systemically Important Banks (SIBs) is critical for the uninterrupted availability of essential banking services to the real economy. The D-SIB framework focuses on the impact that the distress or failure of banks will have on the domestic economy. As opposed to G-SIB framework, D-SIB framework is based on the assessment conducted by the national authorities, who are best placed to evaluate the impact of failure on the local financial system and the local economy. The additional Common Equity Tier 1 (CET1) requirement for D-SIBs was phased-in from April 1, 2016 and became fully effective from April 1, 2019. The additional CET1 requirement will be in addition to the capital conservation buffer. Based on data collected from banks as on March 31, 2017, HDFC Bank was also classified as a D-SIB, along with SBI and ICICI Bank.

What is the target of India's Logistics Policy?

Name the Sikh Guru who developed the Gurmukhi script for writing the Punjabi language?

The natural aging of a lake by nutrient enrichment of its water is termed as:

Maimata is a popular folk dance of which of the following states?

Consider the following statements in reference to Harballabh Sangeet Sammelan.

1. It is one of the oldest festival of Indian classical music in t...

Mohenjodaro site of Harappan civilisation is situated on the bank of which river?

Who reign has been termed as the ‘Golden Period of Kumaun’?

As part of its effort to boost space infrastructure for future human spaceflight missions and Next Generation Launch Vehicles (NGLVs), what is the total...

Which of the following countries was the host country of the 22nd FIFA World Cup Football in 2022?

The Rajpath was decided to be a permanent venue for the Republic Day parade from which of the following year onwards?