Question

RBI has projected the inflation to be ____ for

2023-2024.Solution

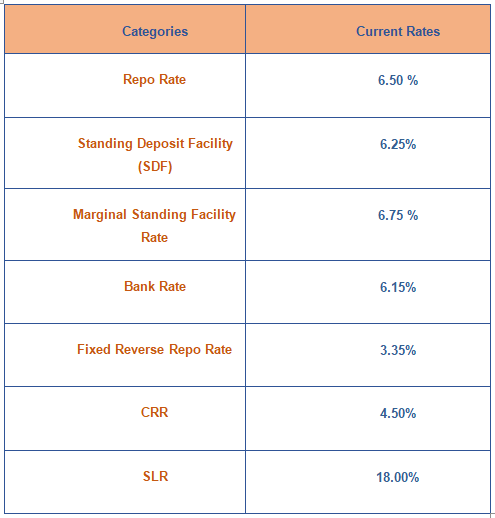

The RBI Monetary Policy Committee ( MPC ) has hiked the repo rate by 25 basis points . The Standing Deposit Facility and Marginal Standing Facility have also been increased by 25 bps . The MPC has raised the repo rate by a total of 250 basis points since May 2022. . RBI will remain focused on the withdrawal of accommodation after this revision too . The rates after revision are as follows -  Inflation in the next fiscal year is expected to be 5.3 per cent for 2023-2024, with Q1 at 5 per cent, Q2 at 5.4 percent, Q3 at 5.4 per cent and Q4 at 5.6 per cent. RBI has pegged real GDP growth for FY24 at 6.4 per cent while growth for FY23 has been pegged at 7 per cent. The MPC has forecast Q1FY24 growth at 7.8 per cent, Q2 at 6.2 percent, Q3 at 6 per cent and Q4 at 5.8 per cent.

Inflation in the next fiscal year is expected to be 5.3 per cent for 2023-2024, with Q1 at 5 per cent, Q2 at 5.4 percent, Q3 at 5.4 per cent and Q4 at 5.6 per cent. RBI has pegged real GDP growth for FY24 at 6.4 per cent while growth for FY23 has been pegged at 7 per cent. The MPC has forecast Q1FY24 growth at 7.8 per cent, Q2 at 6.2 percent, Q3 at 6 per cent and Q4 at 5.8 per cent.

In a test, P got 30% of total marks and failed by 30 marks while Q got 40% of total marks which is 22 more than passing marks. Find the total marks of t...

- Anita spends 18% of her monthly income on rent and 70% of the rest on household expenditure. If she saves Rs. 1,890, then find her monthly income.

80% of a number is equal to 60% of another number. If the total of both numbers is 560, find the difference between them.

- During a college election, two students were in the fray. The one who received 75% of the valid votes won by a difference of 2250 votes. Determine the numb...

In an election, two candidates participated. 20% voters did not cast their votes, out of which 600 votes declared invalid and the winner get 75% of the ...

The sum of the monthly incomes of ‘A’, ‘B’ and ‘C’ is Rs. 40000 which is 4 times the monthly income of ‘C’. If ‘A’ spends 30% of his...

40% students (boys + girls) in a science class are boys. Out of total boys, 60% are literate and 120 are illiterate. Find the number of literate girls i...

Out of a total of 200 students in a class, 60% are boys and the rest are girls. Out of the total number of students who appeared in the class test, 25% ...

In 2018, Pritam used up 72% of his income for expenses. In the following year, his income rose by 20%, while his expenditure increased by 25%. What was ...

- Anita used 35% of her salary for groceries, 50% of the rest on house rent, and saved the remaining amount. If her savings are Rs. 1500, then how much did s...

Relevant for Exams: