Question

What is the purpose of linking India's Structured

Financial Messaging System (SFMS) with the UAE's messaging system?Solution

The Reserve Bank of India (RBI) and the Central Bank of UAE (CBUAE) signed two Memoranda of Understandings (MoUs) to establish a framework to promote settle bilateral trade in respective local currencies, that Indian Rupee and UAE Dirham (AED) and interlinking payments and messaging system. The second MoU on payments and messaging systems has three components. · The first one is to link each country’s Fast Payment Systems (FPSs) – India's Unified Payments Interface (UPI) and UAE's Instant Payment Platform (IPP). The UPI-IPP linkage will enable the users in both countries to make fast, convenient, safe, and cost-effective cross-border funds transfers. · The second component is linking the respective card Switches RuPay and UAESwitch. The linking of Card Switches will facilitate the mutual acceptance of domestic cards and the processing of card transactions. · Third component is to have a direct messaging system between India and UAE, by linking India’s India's Structured Financial Messaging System (SFMS), with the UAE's messaging system. The linkage of messaging systems is aimed to facilitate bilateral financial messaging between the two countries, bypassing the SWIFT messaging system.

In this question, two statements numbered I and II have been given. These statements may be independent causes or effects of independent causes or a com...

Deepika starts her evening walk facing north and walks for 2 km. Then, she takes a right turn and walks for another 2 km. Finally, she takes a left turn...

A, B, C, D, E, F, G and H are sitting around a square table not facing the centre. Some of them are sitting at the corners while some are sitting at the...

If 1st January 2017 was Sunday, then what day of the week was on 1st January 2016?

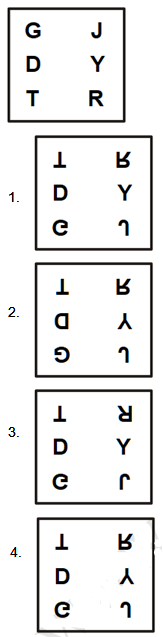

Select the correct water image of the given figure.

Select the option figure in which the given figure is embedded (rotation is NOT allowed).

Three of the following four letter-cluster-pairs are alike in a certain way and thus form a group. Select the pair that does NOT belong to that group. ...

20480, 10240, 5120, 2550, 1280

Vasant says, “I have as many sisters as brother”. Vaishali say, “Each of us sisters has only half as many sisters as brothers”. Assuming that Va...

In this question, there are two statements showing the relationship between the letters and the three conclusions related to them are i, ii and iii. Ass...