Question

The Reserve Bank of India (RBI) has permitted

non-banking finance companies operating as Infrastructure Debt Fund (IDF-NBFCs) to raise money through external commercial borrowings (ECBs) wherein these borrowings will be subject to a minimum tenor of ______years.Solution

The Reserve Bank of India (RBI) has permitted non-banking finance companies operating as Infrastructure Debt Fund (IDF-NBFCs) to raise money through external commercial borrowings (ECBs). These borrowings will be subject to a minimum tenor of five years, and IDF-NBFCs are prohibited from sourcing the ECB loans from the foreign branches of Indian banks, as stated by the RBI in communication to the companies. The aim was to enable IDF-NBFCs to play a more substantial role in financing the infrastructure sector and to bring the relevant regulations into harmony. The revised framework includes the withdrawal of the requirement for a sponsor for the IDFs, and it makes the tripartite agreement optional for Public Private Partnership (PPP) projects. Previously, IDF-NBFCs were mandated to enter into a tripartite agreement with both the dealer and the project authority for investments in PPP infrastructure projects that involved a project authority

For completely randomized design for k treatments and n observations, yif = response from the jth unit receiving ith treatment, �...

A random sample of 100 ball bearings selected from a shipment of 2000 ball bearing has an average diameter of 0.354 inches with standard deviation 0.04...

From standard pack of 52 cards, 3 cards are drawn at random without replacement. The probability of drawing a king, a queen and a jack in order is

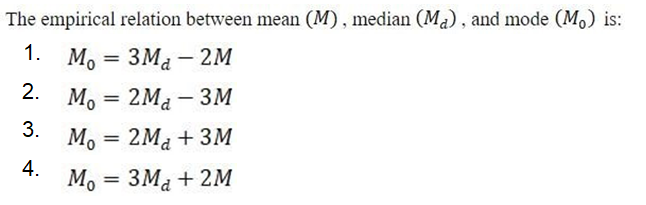

The mean and median of the distribution is 12 and 15. Then the mode equals to:

The coefficient of correlation is the _________ of coefficients of regression.

X1 and X2 represent number of occurrences of event A and 8 that follow Poisson distribution with mean rate λ1 and λ2 , If Y1 and Y2 are inter-occurre...

The memory-less property is followed by which of the following continuous distribution:

If moment generating function of discrete random variable X is (q + pet )n , then E(X2) equals to

If the first, second, and third moment about the origin are 2, 8, and 18 respectively, then third moment about mean is

Relevant for Exams: