Start learning 50% faster. Sign in now

The Reserve Bank of India (RBI) listed out the names of 15 non-banking financial companies (NBFCs) placed under the upper layer as per scale-based regulation (SBR) for 2023-24.LIC Housing Finance Limited ranked first on the list, followed by Bajaj Finance Limited on second and Shriram Finance Limited (formerly Shriram Transport Finance Company Limited) on third.TMF Business Services Limited (formerly Tata Motors Finance Limited) was not included in the list despite qualifying due to its ongoing business reorganisation.

Which of the following statement is true?

Who among the following live on the floors between the floors on which Ji-hu and Min-ho live?

...Six persons A, B, C, D, E, and F live in a six- floor building. The bottommost floor is numbered as 1 and the topmost floor is numbered as 6. B lives t...

Who among the following lives in flat-2 of 4th floor?

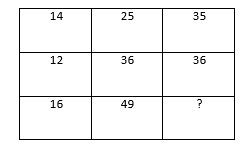

In the following expression find the missing term:

Kajal is working in which company?

Which of the following pair represents vacant floors?

Which of the following is Correct?

How many rows are vacant?