Question

The Reserve Bank of India (RBI) has updated Know Your

Customer (KYC) norms for politically exposed persons (PEPs) who transact with regulated entities (REs), seeking to comply with the recommendations of intergovernmental organisation Financial Action Task Force (FATF).What additional conditions do regulated entities (REs) have to fulfill when establishing a relationship with PEPs, as per the RBI guidelines?Solution

The Reserve Bank of India (RBI) has updated Know Your Customer (KYC) norms for politically exposed persons (PEPs) who transact with regulated entities (REs), seeking to comply with the recommendations of intergovernmental organisation Financial Action Task Force (FATF), PEPs are individuals entrusted with prominent public functions by a foreign country, including the heads of states/governments, senior politicians, senior government or judicial or military officers, senior executives of state-owned corporations and important political party officials. REs have the option of establishing a relationship with PEPs (whether as customer or beneficial owner). REs have to perform the regular customer due diligence and also follow additional conditions prescribed by the RBI to transact with PEPs. Some additional conditions include establishing an appropriate risk management system to determine whether the customer or the beneficial owner is a PEP. REs have to take reasonable measures for establishing the source of funds/ wealth. They also need to get approval from senior management to open an account for a PEP.

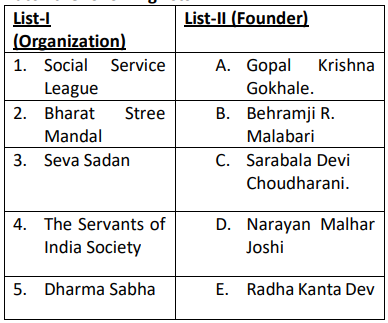

Match the following lists:

Select the correct answer f...

Consider the following statements with reference to Tipu Sultan:

1. He was killed defending his capital Seringapatam in the Fourth Anglo Mysore...

Consider the following movements and arrange them in chronological order:

1. Eka Movement.

2. Tebhaga Movement.

3. Bardoli S...

Justice Miller Committee was related to which of the following aspects?

Consider the following statements with reference to the steps taken by Britishers post revolt of 1857:

1. The number of Indian soldiers increas...

When was the All India Muslim League established during the era of British rule in India?

Which movement did Mahatma Gandhi associate the slogan "Do or Die" with?

Consider the following statements

1. The civil disobedience movement was the widespread participation of Women.

2. The formation of t...

Who initiated the first school for Muslim girls in British India?

With reference to Awadh, Consider the following statements:

1. Saadat Khan was appointed as the governor of Awadh by Mughal Emperor Ahmad Shah....