Start learning 50% faster. Sign in now

Punjab National Bank joined PCAF to enhance its climate-related financial disclosures, aligning with RBI's framework for climate-risk management. In the financial year 2023-24, PNB disclosed its financed emissions in the Business Responsibility and Sustainability Report (BRSR) using the PCAF Standard, a globally accepted methodology. PNB’s decision to join PCAF aligns with the Reserve Bank of India’s (RBI) draft framework on climate-related financial risk disclosures, which requires banks to begin reporting on governance, strategy, and risk management for climate-related financial risks and opportunities from FY 2025-26 onwards, and on metrics and targets related to these risks and opportunities from FY 2027-28 onwards. As a PCAF signatory, PNB joins an international network of financial institutions committed to addressing climate change through robust GHG accounting practices. This association offers PNB access to technical support, industry-leading training, and country-specific emission data, including insights tailored for India. Additionally, PNB will actively engage in global working groups to refine GHG accounting standards and benefit from peer-to-peer knowledge sharing through workshops and webinars. Note – In Sept 2024 – UBI became the first bank to become signatory.

(22² × 8²) ÷ (92.4 ÷ 4.2) =? × 32

?/4 ÷ 9/? = 15% of 800 + `1(2/3)` × `1(1/5)` × 1/2

[∛(3375/19683 )- ∛(125/1728 ) ] ÷ ∛(64/729) = ? - 3/8

(144 ÷ 4)² × (72 ÷ 12)³ = 12 ×? × (25920 ÷10)

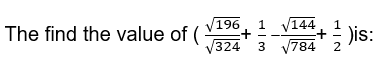

Simplify the following expression:

(525 +175) ² - (525 – 175) ² / (525 × 175)

[(15)³ × (8)²] ÷ (90 × 6) = ?²

What is the value of (152+82) ÷17

345 × 20 ÷ 4 + 28 + 60 = ?