Question

Consider the following statements: (a) Factor

cost in the production is incurred on the various factors of indirect taxes rates in the economy. (b) Market cost in production is an incurred cost on rent, power and interest of loan. Which of the statements given above is/are incorrect?Solution

Cost Income of an economy, i.e., value of its total produced goods and services may be calculated at either the ‘factor cost’ or the ‘market cost’. There is a difference between them. In general, they are also called ‘factor price’ and ‘market price’. India officially used to calculate its national income at factor cost. Since January 2015, the CSO has switched over to calculating it at market price ● Statement 1 incorrect: Factor cost is the ‘input cost’ the producer has to incur in the process of producing something (such as cost of capital, i.e., interest on loans, raw materials, labour, rent, power, etc.). This is also termed as ‘factory price’ or ‘production cost/price’. This is nothing but the ‘price’ of the commodity from the producer’s side. ● Statement 2 Incorrect: Market cost is derived after adding the indirect taxes to the factor cost of the product. It means the cost at which the goods reach the market, i.e., showrooms The formula to calculate is Market Cost= Factor Cost – Subsidies + Indirect Taxes

20 + 160/? × 20 = 420

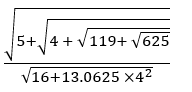

Find the simplified value of the given expression

12.5% of 384 - 16.66% of 66 = √16 + √? + 22

What value should come in place of the question mark (?) in the following question?

60% of 120 – ?% of 64 = 20% of 200

Simplify the following expressions and choose the correct option.

45% of 640 + (2/5 of 350) = ?

5/13 × 104 + 1(2/9) × 198 = 133 + ?

1555.5 + 1000.8 – 1354.3 = ? + 52

√1225 ÷ √49 × √225 = ?2 – 6

(√7225 x √1225)/(√625) = ?

1550 ÷ 62 + 54.6 x 36 = (? x 10) + (28.5 x 40)

Relevant for Exams: