Question

Consider the following statements about Indian

economy: 1. Share of Corporation tax is more than the share of Income Tax in Direct tax collected. 2. Average monthly gross GST collections have constantly increased since 2018. Which of the above statement/s is/are correct?Solution

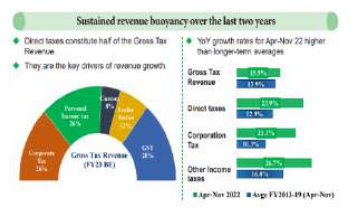

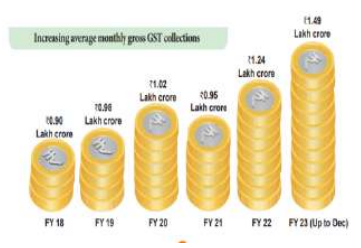

• Statement 1 is correct: The direct taxes, consisting mainly of corporate and personal income tax, constitute around 55 per cent of Gross tax revenue. The contribution of different taxes in GTR (FY23 BE) are:  • Statement 2 is Incorrect: GST collections have been a major source of revenue. They have been on the rise crossing 1.49 lakh cr in 2022 from 0.90 lakh cr in 2018. However, contrary to the trend year 2021 saw a dip in collections. This is better shown below:

• Statement 2 is Incorrect: GST collections have been a major source of revenue. They have been on the rise crossing 1.49 lakh cr in 2022 from 0.90 lakh cr in 2018. However, contrary to the trend year 2021 saw a dip in collections. This is better shown below:

‘A’ and ‘B’ started a business by investing certain sum in the ratio 2:3, respectively for 6 years. If 30% of the total profit i...

A started a business with an investment of Rs.2400. After some months, B joins the business with an investment of Rs.7200 and after two more months C jo...

‘A’ and ‘B’ started a business by investing certain sum in the ratio 6:7, respectively for 6 years. If 22% of the total profit is donated in an ...

A started a business with an investment of Rs.18000. After few months B joined him with an investment of Rs.22500. If at the end of the year, they share...

The contributions made by A and B are in the ratio of 2:5. If 10% of total profit is donated and A gets 8100 as his share of profit, what is the total p...

Amit, Bittu, and Chinky initiated a business venture with investments in the proportions of 8:10:9, respectively. Their shares of the profit were distri...

A starts business with Rs.12000 and after 8 months, B joins with A as his partner. After a year, the profit divided in the 5:7. What is B’s contribut...

‘A’, ‘B’ and ‘C’ started a business by investing Rs. 3000, Rs. 5000 and Rs. 2000, respectively. After 4 months, ‘B’ left and ‘A’ and...

‘A’ started a business with the investment of Rs. 12000. After ‘x’ months and after 3 months from starting ‘B’ and &...

Pankaj and Dheeraj initiated a partnership by investing Rs. 12,750 and Rs. 8,500 respectively. Eight months into the business, Sanjay came on board by c...

Relevant for Exams: