Question

Deposit made towards duty, interest, penalty, fee or any

other sum payable by a person under the provisions of the Customs Act shall be credited to the _____________Solution

Section 51A. Payment of duty, interest, penalty, etc.: (1) Every deposit made towards duty, interest, penalty, fee or any other sum payable by a person under the provisions of this Act or under the Customs Tariff Act, 1975 or under any other law for the time being in force or the rules and regulations made thereunder, using authorised mode of payment shall, subject to such conditions and restrictions, be credited to the electronic cash ledger of such person, to be maintained in such manner, as may be prescribed.

Select the option that is related to the third figure in the same way as the second figure is related to the first figure.

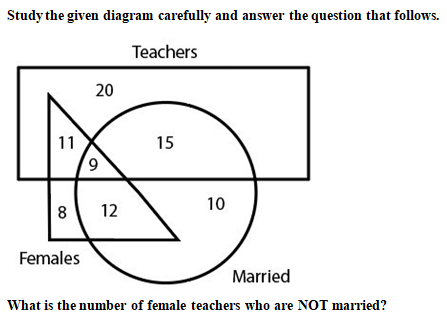

Identify the diagram that best represents the relationship among the given classes.

Men, Football players, Hockey fans.

Which of the following diagrams best depicts the relationship between Male, Brother, Daughter.

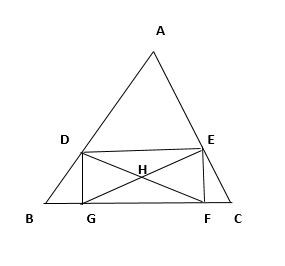

Find the number of triangles in the following figure:

From the four logical diagrams, select the one which best illustrates the relationship among the three given classes in the question: Kind persons, doct...

Which of the following diagram represents the correct relationship between students, intelligent, players.

Select the Venn diagram that best represents the relation between the following classes. Doctor, Lawyer, Male

Which one of the following diagram represents the relationship between Sun, Moon, and Molecule?

India, Asia, Pakistan