Get Started with ixamBee

Start learning 50% faster. Sign in now

Rs 15,000 per month Employees drawing less than Rs 15,000 per month have to mandatorily become members of the EPF . However, an employee who is drawing 'pay ' above prescribed limit (currently Rs 15,000) can become a member with permission of Assistant PF Commissioner, if he and his employer agree.

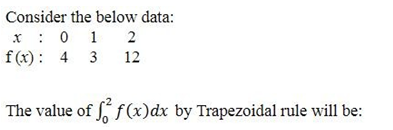

Consider the below data:

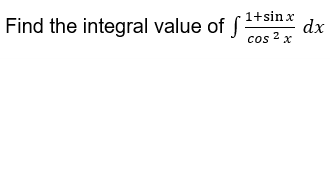

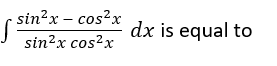

What is the integral value of sin mx