Welcome to ixamBee

Continue with your mobile number

(18 × 9 ÷ 6) × 3 = ? => ? = 27 × 3 => ? = 81

How many classes are there in the given picture?

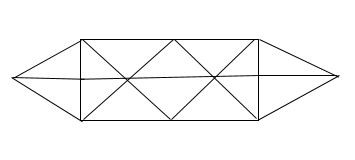

How many triangles are in the given figure?

Find the total number of triangles in the figure.

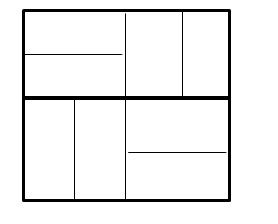

How many rectangles are there in the given figure?

Count the number of squares in the given figure.

How many triangles are there in the figure?

How many triangles are there in the figure given below?

How many triangles are there in the figure given below?

Find the number of triangles in the given figure:

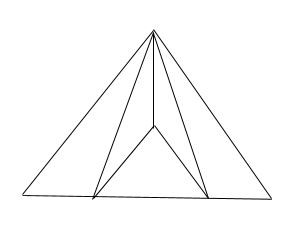

Find the number of quadrilateral in the given figure?