Question

Seven boxes viz. S, T, U, V, W, X and Y are kept one

above other in the form of stack. How many boxes are kept above box W? I. Only two boxes are kept between box T and box X. Only three boxes are kept above box V. Box T and V are kept together. Only one box is kept between box W and box Y. Box S is neither kept at bottom nor adjacent to box T. II. Box U is kept second from top. Box W is kept at any place above box Y. Only three boxes are kept between box X and box U. Box V, which is neither kept adjacent to box U nor box X, which is kept at s gap of two box from S. Box T doesn’t kept adjacent to box X but kept at any place below box S. Each of the questions below consists of a question and two statements numbered I and II given below it. You have to decide whether the data provided in the statements are sufficient to answer the question:Solution

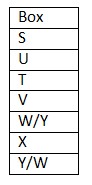

From I: We have: Only three boxes are kept above box V. Box T and V are kept together. Only two boxes are kept between box T and box X Only one box is kept between box W and box Y. Box S is neither kept at bottom nor adjacent to box T, that means box S is kept at top and box X is kept below box T. Based on above given information we have:  Clearly, we don’t know exact position of box W. Hence, statement I is not sufficient. From II: We have: Box U is kept second from top. Only three boxes are kept between box X and box U, that means box X is kept second from bottom. Box V, which is neither kept adjacent to box U nor box X, which is kept at s gap of two box from S, that means box V is kept fourth from bottom. Box T doesn’t kept adjacent to box X but kept at any place below box S, that means box S is kept at top. Box W is kept at any place above box Y, that means box Y is kept at bottom.

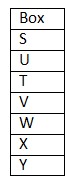

Clearly, we don’t know exact position of box W. Hence, statement I is not sufficient. From II: We have: Box U is kept second from top. Only three boxes are kept between box X and box U, that means box X is kept second from bottom. Box V, which is neither kept adjacent to box U nor box X, which is kept at s gap of two box from S, that means box V is kept fourth from bottom. Box T doesn’t kept adjacent to box X but kept at any place below box S, that means box S is kept at top. Box W is kept at any place above box Y, that means box Y is kept at bottom.  Clearly, only four boxes are kept above box W. Hence, statement II alone is sufficient.

Clearly, only four boxes are kept above box W. Hence, statement II alone is sufficient.

Queen Karnavati repelled the attack of the army of Mughal emperor Shah Jahan that was led by chieftain _________________ .

In regards to Mountains in Uttarakhand, which of the following is not correctly matched?

Renowned personality Supriya Devi recently passed away, she was related to the field of:

The Headquarters of INTERPOL is situated at

Which Indian badminton player won her first senior international title by winning the women’s singles at the Belgian International 2024?

Above what financial threshold has the Finance Ministry simplified expenditure rules to boost capital expenditures?

In which of the following state Murlen National park is located?

Who is the brand ambassador of Bata India?

According to poet Bharat, during the reign of which king, Garhwal was at the peak of its progress?

Analysis of any financial Statement comprises

Relevant for Exams: