Question

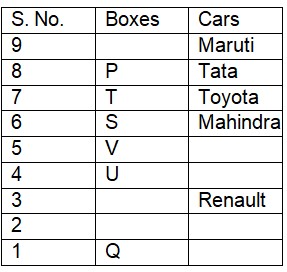

How many boxes are there between the box of Honda and

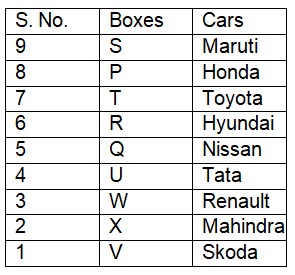

Renault? Study the following information carefully to answer the given questions: Nine boxes P, Q, R, S, T, U, V, W and X are placed one above the other but not necessarily in the same order. Each Box have different brands of Car in it viz. Hyundai, Honda, Tata, Maruti, Toyota, Renault, Mahindra, Skoda and Nissan but not necessarily in the same order. (i) There are two boxes between Box V and Box of Tata. Box of Hyundai placed just above the Box of Nissan. Less than three boxes are there between the box of W and R. More than one and less than four boxes are there between the boxes of Nissan and Honda. (ii) Box of Renault is placed just below the box of U. There are three boxes between Box P and U & Box P is place above U. Not more than two boxes are there between the box of Tata and Box T which placed below the Box of Maruti. (iii) Car of Hyundai is in the box R which is placed above Box X. Three boxes are there between the box V and box Q. Cars of Renault and Toyota are not in the box Q. Box T is place third from the top. Box of Mahindra is placed just above Box V. (iv) Box Q is not placed just above or below to the Box T but it is placed above Box X. More than two boxes are there between the box Q and box S which is placed above box U. (v) Box of Tata is not placed on the top and Box of Renault is not placed on the bottom. Only one box is placed between the boxes of Toyota and Maruti. Box P does not contain Car of Skoda.Solution

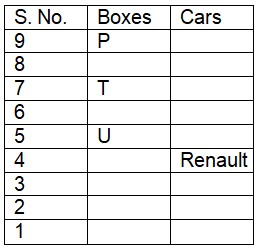

From(iii), It says Box T is place third from the top. So, T will be places at place no. 7. From (iv), Q cannot be placed at place no. 6 and 8. From (v), Box of Tata and Renault cannot be placed at place no. 9 and 1 respectively. From (ii), there will be two cases: P can be kept at place no. 9 and 8 and U can be kept at place no. 5 and 4. Box of Renault kept at place either on no. 4 or 3. From (iii) and (iv), case 1 will get discarded as there are three boxes are there between the box V and box Q and we don’t have at that place. Case-1  Case-2

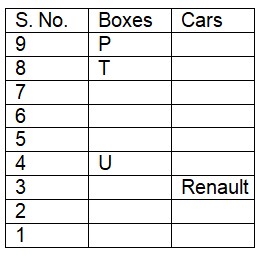

Case-2  From (iii), (v) and (iv), Three boxes are there between the box V and box Q. More than two boxes are there between the box Q and box S which is placed above box U. There are two boxes between Box V and Box of tata. Box Q is not placed just above or below to the Box T but it is placed above Box X. From (iii), Box of Mahindra is kept at place no. 2. From (ii), Box T which placed below the Box of Maruti. Box of Maruti is kept at place no. 9. From (v), Box of Toyota is kept at place no. 7. From (x), Less than three boxes are there between the box of W and R. So, W and R will be kept at place no. 3 and 6 respectively. Box X will be kept at place no. 2. Box of Nissan will be kept at place no. 5. Box of Honda and Skoda will be kept at place no. 8 and 1 respectively. Case-2a

From (iii), (v) and (iv), Three boxes are there between the box V and box Q. More than two boxes are there between the box Q and box S which is placed above box U. There are two boxes between Box V and Box of tata. Box Q is not placed just above or below to the Box T but it is placed above Box X. From (iii), Box of Mahindra is kept at place no. 2. From (ii), Box T which placed below the Box of Maruti. Box of Maruti is kept at place no. 9. From (v), Box of Toyota is kept at place no. 7. From (x), Less than three boxes are there between the box of W and R. So, W and R will be kept at place no. 3 and 6 respectively. Box X will be kept at place no. 2. Box of Nissan will be kept at place no. 5. Box of Honda and Skoda will be kept at place no. 8 and 1 respectively. Case-2a  From (iii), Box of Mahindra is kept at place no. 6. From (ii), Box T which placed below the Box of Maruti. Box of Maruti is kept at place no. 9. From (v), Box of Maruti is kept at place no. 7. This case will get discarded as less than three boxes are there between the box of W and R which is placed above Box X. Case-2b

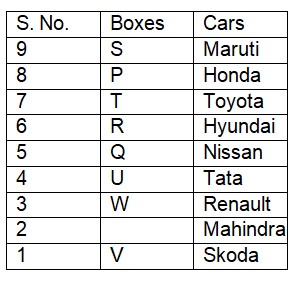

From (iii), Box of Mahindra is kept at place no. 6. From (ii), Box T which placed below the Box of Maruti. Box of Maruti is kept at place no. 9. From (v), Box of Maruti is kept at place no. 7. This case will get discarded as less than three boxes are there between the box of W and R which is placed above Box X. Case-2b  Final arrangement as shown below:

Final arrangement as shown below:

Currency of Cuba is

A film based on a famous Indian personality recently won the US Documentary Grand Jury Award. Who is the person?

Which of the following is a Surface-to-Air Missile (SAM)?

Who received the Devadasi National Award in 2007 for her contributions to Kuchipudi dance?

The World Trade Organization (WTO) ministerial meeting for 2017 is to be hosted by

Kuki dance is associated with which Indian state/UT?

Dharmadhikari Committee is for –

The headquarters of the West Central Railway is situated in which city?

Which country withdrew from the United Nations World Tourism Organization in 2022?

Commercial Paper (CP) is a zero-coupon security, the face value of which is payable at the maturity

Relevant for Exams: