Question

Who among of the following person sits immediate right

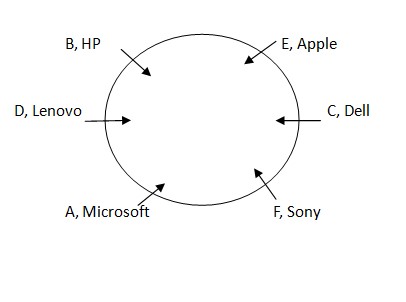

of A? Study the following information carefully and answer the below questions Six persons- A, B, C, D, E, and F are sitting on the circular table facing the center. They are using different types of laptops- HP, Apple, Dell, Lenovo, Microsoft, and Sony but not necessarily in the same order. D sits second to the left of the one who uses Sony laptops. The one who uses Sony laptops and the one who uses Dell laptops are immediate neighbors. B sits opposite to the one who sits immediate right of A. B neither uses Sony nor Dell. The one who uses HP sits second to the left of A. The one who uses Lenovo sits immediate left of the one who uses Microsoft. D neither uses Microsoft nor Apple. Either B or E uses Apple. F does not use Dell.Solution

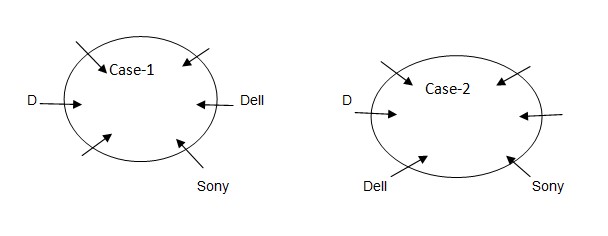

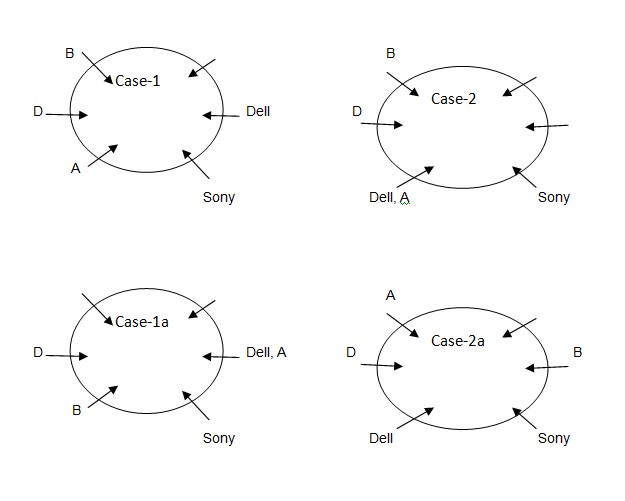

We have, D sits second to the left of the one who uses Sony laptops. The one who uses Sony laptops and the one who uses Dell laptops are immediate neighbors. From the above condition, there are two possibilities.  Again we have, B sits opposite to the one who sits immediate right of A. B neither uses Sony nor Dell. From the above condition, there are four possibilities.

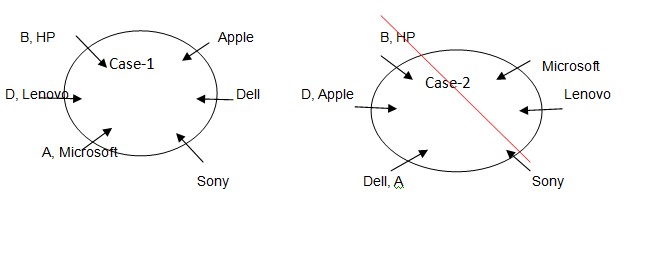

Again we have, B sits opposite to the one who sits immediate right of A. B neither uses Sony nor Dell. From the above condition, there are four possibilities.  Again we have, The one who uses HP sits second to the left of A. The one who uses Lenovo sits immediate left of the one who uses Microsoft. D neither uses Microsoft nor Apple. From the above condition, Case2, case1a, and case2a get eliminated.

Again we have, The one who uses HP sits second to the left of A. The one who uses Lenovo sits immediate left of the one who uses Microsoft. D neither uses Microsoft nor Apple. From the above condition, Case2, case1a, and case2a get eliminated.

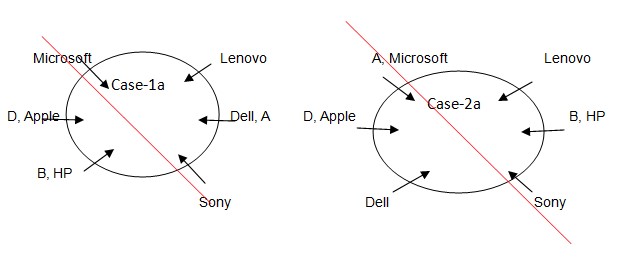

Again we have, Either B or E uses Apple. F does not use Dell. From the above condition, case1 shows the final arrangement

Again we have, Either B or E uses Apple. F does not use Dell. From the above condition, case1 shows the final arrangement

Which of the following is an example of “tangible assets”?

What is the due date for filing GSTR-9, the annual return, as per GST law?

Goods returned by customer will be debited to which account?

Digital signature, one of the important components of e-commerce is defined according to Section _________ of Information Technology Act, 2000.

Which among the following is primarily not a Refinancing Financial Institution?

What is the primary objective of the Reserve Bank of India (RBI)?

An asset costing ₹12 lakh, useful life 10 years, residual value ₹2 lakh. Calculate annual depreciation using straight-line method (SLM).

Who among the following can issue Certificate of Deposits to raise short term resources?

Under GST, the tax levied on intra-state supply of goods is shared between:

Input = 10,000 units @ ₹20/unit, Normal loss = 10%, Scrap value = ₹2/unit. What is cost per unit of output assuming no abnormal loss?

Relevant for Exams: