Question

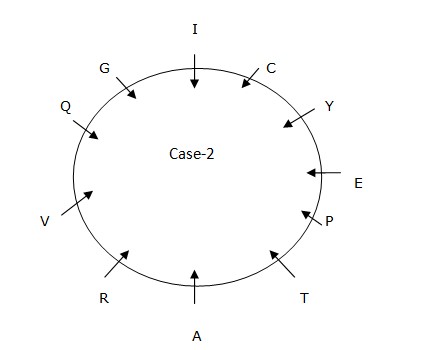

How many persons sit between V and E when counted from

the left of V? Study the following information carefully and answer the questions given below it. There are eleven persons A, P, C, Q, E, R, G, T, I, V and Y are sitting in a circular table facing towards the centre. Only 5 persons sit between A and I when counted from the right of A. Y sits second to the left of I. T sits third to the left of Y. Only four persons sit between Y and V. Number of letters between E and I in the alphabetical series is same as the number of persons sitting between A and G. Q is an immediate neighbour of V. P sits fifth to the right of Q. E sits second to the left of C.Solution

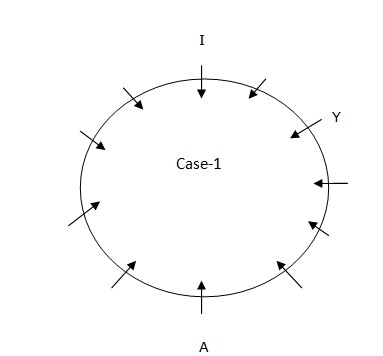

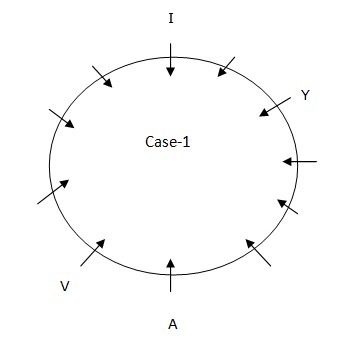

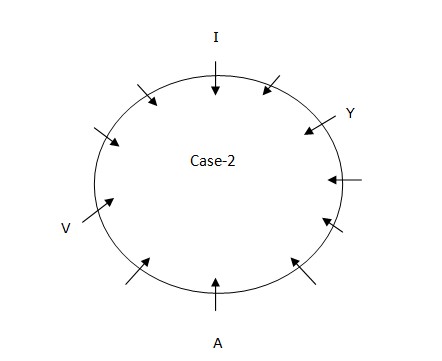

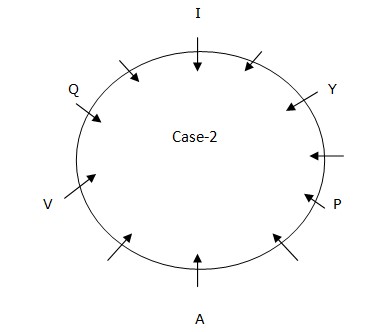

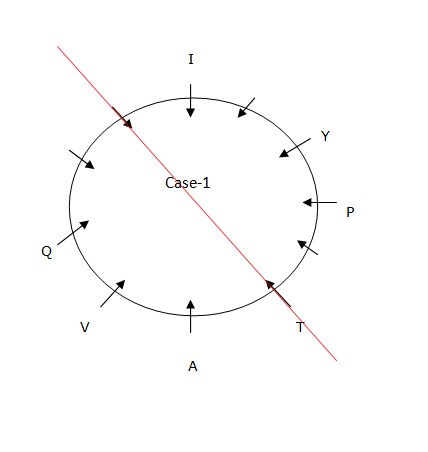

Only 5 persons sit between A and I when counted from the right of A. Y sits second to the left of I.  Only four persons sit between Y and V. Here we get two possibilities Case (1) and Case (2).

Only four persons sit between Y and V. Here we get two possibilities Case (1) and Case (2).

Q is an immediate neighbor of V. P sits fifth to the right of Q.

Q is an immediate neighbor of V. P sits fifth to the right of Q.

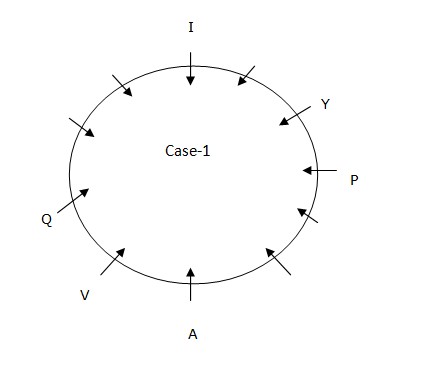

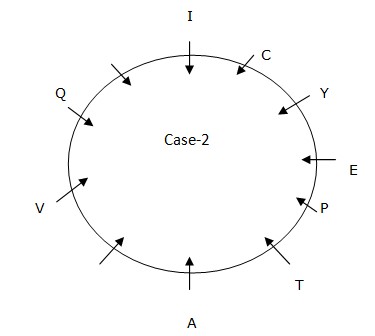

T sits third to the left of Y. E sits second to the left of C. Here Case 1 gets eliminated.

T sits third to the left of Y. E sits second to the left of C. Here Case 1 gets eliminated.

Number of letters between E and I in the alphabetical series is same as the number of persons sitting between A and G.

Number of letters between E and I in the alphabetical series is same as the number of persons sitting between A and G.

What is the maximum number of members that can be on the National Financial Reporting Authority (NFRA)?

All revenues received by the Union Government by way of taxes and other receipts for the conduct of Government business are credited to the?

The acronym SRO, being used in the capital market for various market participants, stands for which one of the following?

Which of the following Statements about the Ayushman Bharat Digital Mission is/are True?

I- It aims to provide digital health IDs for all Indian ...

Consider the following statements about the Bureau of Pharma PSUs of India (BPPI):

1. It is the implementing agency of Pradhan Mantri Bhartiya Ja...

Which of the following organization have signed agreement to develop sustainable water policy in Odisa ?

Regarding ‘Atal Pension Yojana’, which of the following statements is/are correct?

1. It is a minimum guaranteed pension scheme mainly target...

What are the sources from which corporates can raise External Commercial Borrowings (ECBs)?

The 'Ration Aapke Gram' scheme was recently launched in _____________.

What is the value of the money multiplier when initial deposits are ₹ 500 crores and LRR is 10 %.

Relevant for Exams: