Question

In a certain way, D is related to R, P is related to C,

in the same way S is related to who among them following person? Study the following information carefully and answer the given Questions below. Ten people are sitting in two parallel rows. A, B, C, D and E are sitting in row 1 facing South. P, Q, R, S and T are sitting in row 2 facing north. The person sitting in row 1 exactly faces the person sitting in row 2. They like five different cars, Benz, BMW, Audi, Toyotto and Swift. Exactly two people like the same Car and the persons who like the same Car don’t sit in the same row. Q sits at one of the extreme ends. There is only one person sits between Q and the one who faces the person who like Benz Car. D sits to the immediate right of the person who like Benz Car. There is one person sits between Q and R. R likes Benz Car. Number of persons who sits to the right of R is same as that of number of person who sits to the left of C. The person who likes Toyotto Car sits immediate left of R. Two people sit between T and P. T sits somewhere to left of P. T faces the one who like Toyotto Car. One of the people who like Swift Car is an immediate neighbor of the one who like Audi Car in row 2. E sits left of A. E is an immediate neighbor of B. B faces the person who sits to the immediate right of the person who like Swift Car. S and B doesn’t like Swift Car. There is only one person sits between D and the one who like BMW Car.Solution

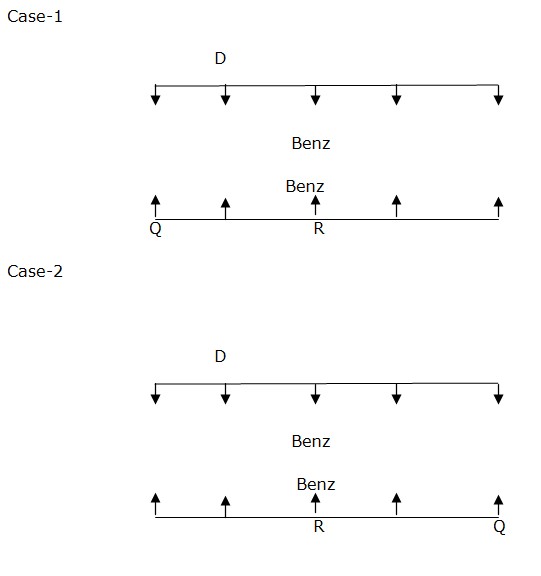

Q sits at one of the extreme ends. There is only one person sits between Q and the one who faces the person who like Benz Car. D sits to the immediate right of the person who like Benz Car. There is one person sits between Q and R. R like Benz Car.  Number of persons who sits to the right of R is same as that of number of person who sits to the left of C. The person who likes Toyotto Car sits immediate left of R. Case-1

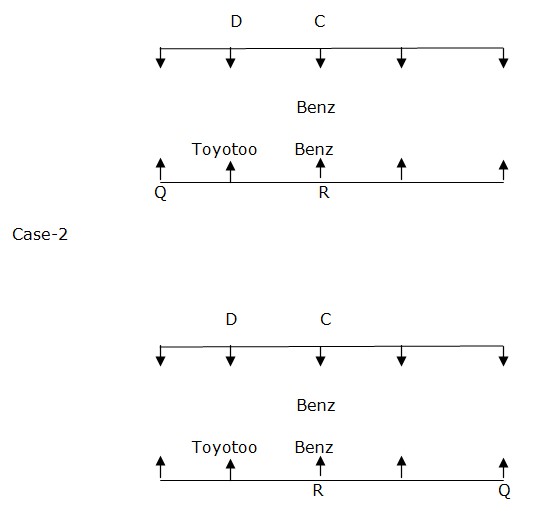

Number of persons who sits to the right of R is same as that of number of person who sits to the left of C. The person who likes Toyotto Car sits immediate left of R. Case-1  Two people sit between T and P. T sits somewhere to left of P. T faces the one who like Toyotto Car. Case-1

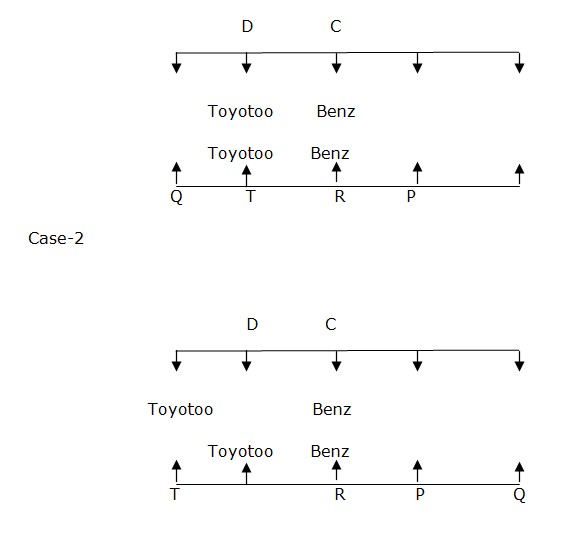

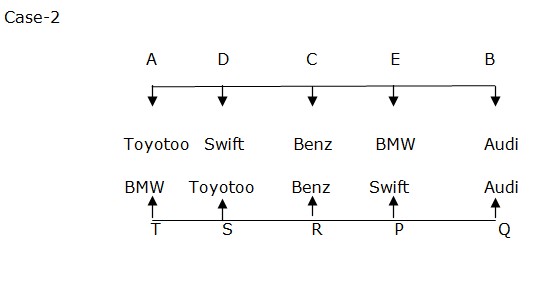

Two people sit between T and P. T sits somewhere to left of P. T faces the one who like Toyotto Car. Case-1  One of the people who like Swift Car is an immediate neighbour of the one who like Audi Car in row 2. E sits left of A. E is an immediate neighbour of B. B faces the person who sits to the immediate right of the person who like Swift Car. S and B doesn’t like Swift Car. There is only one person sits between D and the one who like BMW Car. Case 1 doesn’t satisfy above condition. So this case is eliminated. And Case 2 will be the final arrangement.

One of the people who like Swift Car is an immediate neighbour of the one who like Audi Car in row 2. E sits left of A. E is an immediate neighbour of B. B faces the person who sits to the immediate right of the person who like Swift Car. S and B doesn’t like Swift Car. There is only one person sits between D and the one who like BMW Car. Case 1 doesn’t satisfy above condition. So this case is eliminated. And Case 2 will be the final arrangement.

Which is not a short day plant?

The process of removal of lint from epidermal layer of the cotton seed is called as

Water is drawn upwards from the water table in a continuous network of pores. This upward movement of water occurs only in saturated soils is called

The vector of Corn Stunt Disease is:

The universal pollinizer or donor variety of sweet cherry is identified as:

What term describes the ratio between marketable crop yield and water used in evapotranspiration?

At what Brix reading on a refractometer is sugarcane considered mature?

Which female hormone is produced by the corpus luteum favoring the implementation of embryo?

Which of the following viral diseases of tomatoes is transmitted by the whitefly, Bemisia tabaci, in a persistent manner?

_____________ is the raised ridge formed in the middle of a plowed field when plowing begins from the center. It's created as furrow slices are collecte...

Relevant for Exams: