Question

If C is related to R and P is related to N in a certain

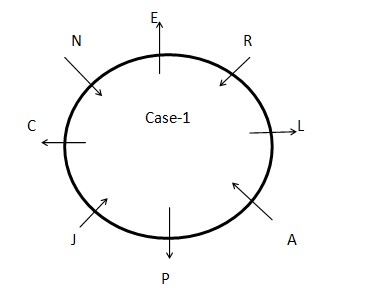

way, then A is related to which of the following person? Study the following information carefully and answer the questions given below. Eight persons A, C, E, J, L, N, P and R are sitting on a circular table such that four persons are facing inwards while four persons are facing outwards alternatively, but not necessarily in the same order. P sits third to the left of R where as N sits second to the right of R. Two persons are sitting between N and L. The number of persons between L and P is same as the number of persons between R and A, when counted from the right of L and A. J neither sits facing outside nor adjacent to N but adjacent to C.Solution

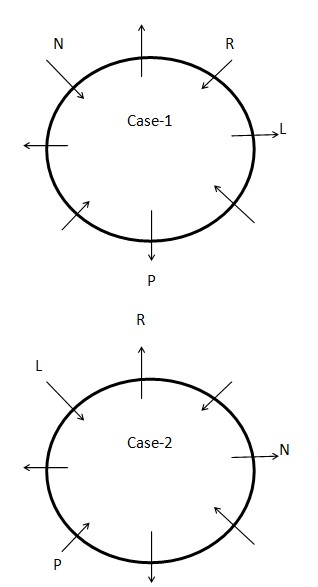

P sits third to the left of R whereas N sits second to the right of R. Two persons are sitting between N and L.  The number of persons between L and P is same as the number of persons between R and A, when counted from the right of L and A. J neither sits facing outside nor adjacent to N but adjacent to C. Hence, case 2 gets eliminated

The number of persons between L and P is same as the number of persons between R and A, when counted from the right of L and A. J neither sits facing outside nor adjacent to N but adjacent to C. Hence, case 2 gets eliminated

If a government uses barriers to foreign products such as biases against a foreign company's bids, or product standards that go against a foreign compan...

Following is an example of high volume sprayer

Which fungal disease affects the seedling emergence from the soil in two phases, namely pre-emergence and post-emergence damping-off?

The ideal temperature range for optimum growth and flowering of Carnation is

Which one of the following is not the instrument for credit control:

Disease caused by viruses is

The process by which a farmer allocates limited farm resources among various agricultural activities to maximize returns is known as:

A molecule causing plant disease having spiral or helical structure and culturable on artificial nutrient medium is associated with:

Which of the following is not a component of seed vigor?

Which of the following is an important steroid present in fenugreek?

Relevant for Exams: