Start learning 50% faster. Sign in now

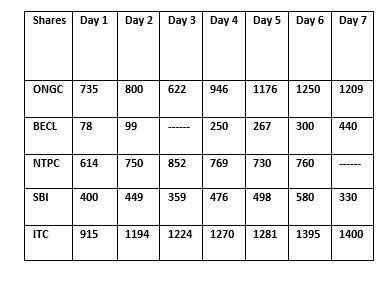

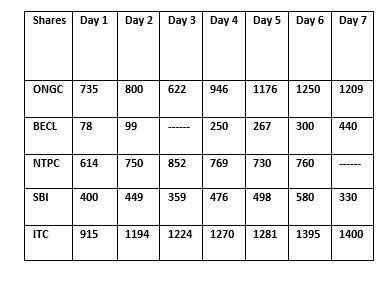

Answer the questions based on the following information. The given data in the table show the prices (for both buying and selling) of five different stocks over a period of one week.

Note: 1. Aman purchased 9000 shares of BECL and 1700 shares of SBI on the 2nd day and sold all the shares of both companies on the 3rd days. In the process, his profit or loss is nil.

2. Average of the prices of shares on day 7 of all the companies together was Rs. 827

Answer the questions based on the following information. The given data in the table show the prices (for both buying and selling) of five different stocks over a period of one week.

Note: 1. Aman purchased 9000 shares of BECL and 1700 shares of SBI on the 2nd day and sold all the shares of both companies on the 3rd days. In the process, his profit or loss is nil.

2. Average of the prices of shares on day 7 of all the companies together was Rs. 827

Find the difference between average of the prices of shares on day 3 and Average of the prices of shares on day 7 of all the companies together?

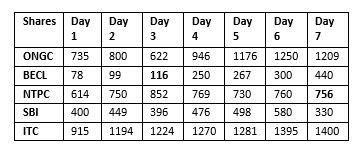

From note 1,

Loss by selling SBI = (449 – 359) × 1700= 90 × 1700 = Rs.1,53,000

That means he has earned Rs. 1,53,000 by selling 9000 shares of BECL.

C.P. of 9000 shares of BECL on 2nd day = 99 x 9000 = 8,91,000

∴ S.P of 9000 shares of BECL on 3rd day = 8,91,000 + 1,53,000 = Rs. 10,44,000

∴ S.P. of 1 share of BECL on 3rd day = 1044000/9000 = Rs.116

From note 2, total price of shares on day 7 of all the companies together = 827 × 5 = Rs.4135

∴ Price of NTPC on 7th day = 4135 – (1209 + 440 + 330 + 1400) = 4135 – 3379 = 756

Average price on Day 3 =622+116+852+396+1224/5 = 3210/5 = 642

Average price on Day 7 = 827 ( given in note 2)

∴Required difference = 827 - 642 = 185

Average price on Day 3 =622+116+852+396+1224/5 = 3210/5 = 642

Average price on Day 7 = 827 ( given in note 2)

∴Required difference = 827 - 642 = 185

Inflationary pressures continue to have a stronger effect on the monetary policy, forcing the regulator to persist with the wait – but- watch policy.

wait – and- watch instead of wait – but- watch

What is the ratio of the price of NTPC on the 2nd day to the price of ONGC on the 6thday ?

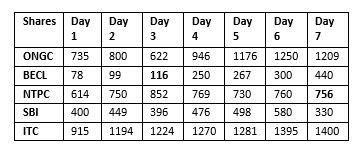

From note 1,

Loss by selling SBI = (449 – 359) × 1700= 90 × 1700 = Rs.1,53,000

That means he has earned Rs. 1,53,000 by selling 9000 shares of BECL.

C.P. of 9000 shares of BECL on 2nd day = 99 x 9000 = 8,91,000

∴ S.P of 9000 shares of BECL on 3rd day = 8,91,000 + 1,53,000 = Rs. 10,44,000

∴ S.P. of 1 share of BECL on 3rd day = 1044000/9000 = Rs.116

From note 2, total price of shares on day 7 of all the companies together = 827 × 5 = Rs.4135

∴ Price of NTPC on 7th day = 4135 – (1209 + 440 + 330 + 1400) = 4135 – 3379 = 756

price of NTPC on the 2ndday =Rs. 750

price of ONGC on the 6th day = Rs. 1,250

∴Required ratio = 750 : 1250 = 3 : 5

price of NTPC on the 2ndday =Rs. 750

price of ONGC on the 6th day = Rs. 1,250

∴Required ratio = 750 : 1250 = 3 : 5

The RBI has judiciously drew up a road-map which should be good for the country.

drawn instead of drew

The apex bank hiked banks provisioning requirement for 2.75 percent from the existing 2 percent on restructured standard loan accounts.

to instead of for