Are you an RBI Grade B aspirant? Or interested in any other Bank or Regulatory body exams? Then this blog is for you. If you have attempted these exams earlier or even a fresher, you might have or may come across questions like ‘What is inflation and its impact on economy?’, ‘Can you explain RBI’s role in maintaining financial stability?’, ‘What is the monetary policy of RBI and its objectives’ or even ‘Have you ever wondered why the personal loan interests or housing loan EMIs change?’. These are some of the regular questions asked in the exams or even in interview of the exams mentioned above.

Here, in this article, I won’t go to explaining the answers to the questions in detail but would like to throw some light on one of the important aspects of RBI’s monetary policy tools- the Bank rate and Repo rate. This is meant to help you get a grasp on the subject and enable you to answer any question related to it.

What is Bank rate and Repo rate?

The RBI manages monetary policies to regulate the money supply and control inflation. Inflation is the steady increase in price of goods and services in an economy over a period of time. It can impact the nation’s economy by encouraging spending or in other terms, people will start buying goods before it’s prices increase further; thereby stimulating demand, increasing output and creating jobs. But at the same time, high and persistent inflation can lead to decrease in the purchasing power of money, reducing it’s savings’ value. Thus, leading to increased mobility of money in the market and resulting in economic instability. Hence to achieve its monetary policy goals RBI uses some tools as setting interest rates, reserve requirements, etc.

In finance talks, two important terms are bank rate and repo rate, both about interest rates but with distinct roles and involving different entities. Knowing their difference is key to understanding how central banks manage the economy and impact borrowing and lending costs.

The Reserve Bank of India (RBI) uses bank rates and repo rates as tools for managing finance and the economy in various ways:

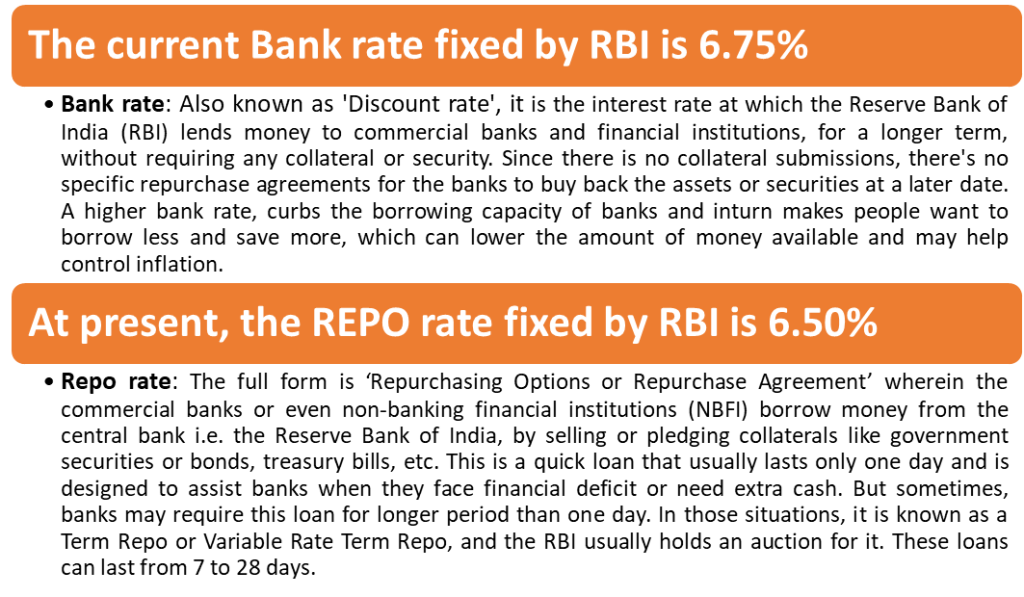

Bank Rate: This is the interest rate at which RBI lends money to commercial banks without any collateral. By changing the bank rate, RBI can influence borrowing costs for banks. When the bank rate is high, borrowing becomes expensive, which can help in controlling inflation. On the other hand, reducing the bank rate makes borrowing cheaper, encouraging banks to lend more and stimulate economic activity.

Repo Rate: This is the rate at which RBI lends money to commercial banks against government securities. By adjusting the repo rate, RBI can influence short-term interest rates and liquidity in the economy. Increasing the repo rate makes borrowing more expensive for banks, leading to lower liquidity and reduced spending, which can help in controlling inflation. Conversely, lowering the repo rate encourages borrowing and spending, thereby stimulating economic growth.

Key differences between Bank rate and Repo rate

Impact of Bank rate and Repo rate

- Reduces the flow of money within the country, thereby controlling the money supply chain

- If interest rates set by RBI are high, then banks borrow less, lending less to consumers, inturn reducing the money supply in economy.

- When the interest rates towards banks are increased by RBI, banks also tend to increase the interest rates on home loans, personal loans etc., thereby affecting the existing and new customers.

- At the same time, banks also increase the interest rates on FDs. This can be good for people who depend on fixed income from their investments.

- Lowering the repo rate can boost economic activity by encouraging borrowing and investment, potentially creating more jobs. However, raising the repo rate to control inflation may slow down economic growth, affecting job opportunities for people.

- Bank rates are not changed frequently, but when used it indicates a significant policy shift; while repo rates are more flexible and adjusted frequently to stabilize the money market.

What is Reverse Repo?

The reverse repo rate is like the opposite of the repo rate. It’s the rate at which the RBI borrows money from commercial banks in India. This happens when banks have extra money and they keep it with the RBI for a short time. In this case, banks earn interest on this fund deposited with RBI. The current reverse repo rate is 3.35%.

Conclusion

When the nation’s economy is doing well, interest rates tend to rise, and banks want to make more money from lending when the economy is strong. On the contrary, during economic downturns, interest rates may decrease to encourage borrowing and spending. So, to make things more relatable, if the bank rate or repo rate goes up, it could result in increased home loan interest rates and EMIs for customers. On the other hand, if these rates go down, customers may see lower interest rates and EMIs, making loans more affordable. In summary, the RBI uses both bank rates and repo rates as tools to control inflation, manage liquidity or money flow in the economy, and promote economic growth by influencing borrowing and lending activities among banks and financial institutions and their customers.

To help you prepare 50% faster for competitive exams, ixamBee provides a free Mock Test Series and all the Current Affairs in English and Current Affairs in Hindi in the BeePedia capsules for GA Preparation. You can also get the latest updates for Bank PO, Bank Clerk, SSC, RBI Grade B, NABARD, and Other Government Jobs.

Also Read

RBI Assistant vs Bank PO: Which One is Better?

Understanding the RBI Retail Direct Scheme