The term “Rupee” is derived for the Sanskrit Word “Raupiya” which means “Silver”. It is assumed that the First Rupee has been introduced by Sher Shah Suri (1486-1545). At his time the ratio of the rupee to the copper pieces was 40:1 (40 copper pieces per rupee). The event called “the fall of the Rupee” took place in the nineteenth century after the discovery of large quantities of silver in comparison to gold (One of the strongest economies of the world were at gold standard at that time).

In today’s article, I will talk about the History of the Indian currency system along with different types of methods through which currency is issued.

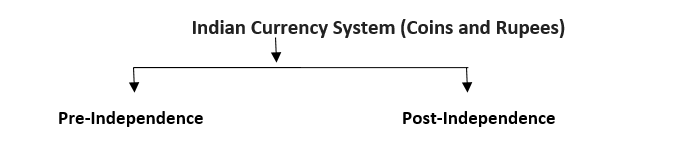

History of Indian Currency System:

Reserve bank of India is the Currency Issuing Authority of India. It has the sole right to issue currency notes in India. This power has been given under Section 22 of the Reserve bank of India Act. RBI’s responsibility is not only limited to issuing or withdrawing banking notes but also the circulation and exchange of banknotes and coins. To understand the Indian currency system in detail, let’s look at the history of the Indian currency system.

Pre-Decimal Coins issues (1950-1957): In this, the first currency coins that were introduced in the denominations of 1 paisa, ½ 1 and 2 annas, ¼, ½ and 1 rupee note.

Decimal Coins issues (1957 onwards):

- This system was introduced in 1957.

- It was comprised of units 1, 2, 5,10,25,50 paisa also known as Naya Paisa and One Rupee.

- One paisa was made of Bronze.

- 2, 5, and 10 paise were made of Cupro-nickel.

- 25 paisa and One rupee were made of Nickel.

Note: The term Naya Paisa was removed in 1964 and they were called “Paisa”.

Issuing of Notes:

Pre-Independence: The Reserve bank of India started printing notes with a denomination of 2,5,10,50,100,1000 and 10000 notes. The Government of India continued printing One rupee notes.

Post–Independence:

- New design of banknotes was introduced.

- Rupees 20 and 50 banknotes were introduced.

- 500 rupees note was introduced in 1987.

- 1000 rupee note was introduced in the year 2000.

Note: One and Two rupee notes got discontinued in the year 1995.

History of Paper Currency In India:

After passing of the Currency Act of 1861, paper currency notes began to be issued at the time of British Rule in India. In order to circulate the paper notes British Government of India entered into agreements with the three Presidency Banks i.e. Bank of Bengal, Bank of Bombay and Bank of Madras. These agreements got terminated is 1867 due to difficulties in the redemption of the notes and all the tasks related to paper issuing were given to Controller of Currency and Mint Masters, Accountant General of India.

Note:

On March 06, 1934, Under Section 22 of the RBI Act, RBI was given the sole right to issue and manage the paper currency up to 10,000 Rupee denomination notes. This came into effect from April 01, 1935.

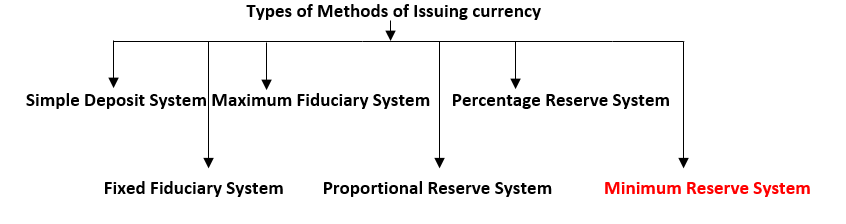

Method of Issuing Currency:

To create the flow and availability of Currency notes, Central banks across the globe have adopted a number of methods through which the currency got available in the market. Those are broadly classified below:

Simple Deposit System:

Under this method, the entire value of currency issued by the central banks of the country is printed on the basis of the availability of gold or silver reserve in physical or in monetary form.

Fixed Fiduciary System:

In this method, the regulator can issue only a fixed amount of currency notes against securities. However, for additional printing of notes precious metals value is required. This part of the issue is called the Fiduciary issue. The main objective of this system is to maintain the convertibility of paper money into metal. The limit under this is fixed after giving due consideration to the monetary requirements or can be increased or decreased with an amendment in the law by the government.

Maximum Fiduciary System:

Under this method, the regulator fixes the maximum limit up to which they are allowed to issue currency notes either with or without the reserves of precious metals. The maximum limit cannot be breached.

Proportional Reserve System:

This method is based on the Banking principle of issuing notes. Under this, the issue of paper currency is done in two proportions i.e. some in the form of precious metals (Gold or Silver) and the remaining is backed by the reserves (Government securities). The proportion of precious metals usually varies from 25% to 40% (Precious metals) and the rest was backed with securities (60% to 75%).

Note: This method became popular after World War I. India also adopted this method in 1927 (with the recommendation of Hilton Young commission), later replaced by the Minimum Reserve method in 1957.

Percentage Reserve System:

In this method, a certain percentage is kept in the form of Foreign exchange, foreign securities, deposits with foreign banks and the rest of the percentage in the form of gold reserves. India adopted this system at the time of World War II, this time RBI was allowed to keep 60% of the reserve in the form of securities and the rest in the form of precious metals.

Minimum Reserve System:

Under this method, a minimum amount of gold (Precious metals) is fixed. Here, Central Bank is authorized to issue any amount of paper currency notes on the basis of the minimum gold reserves. This system has been adopted by India since 1957. Reserve Bank of India is authorized to hold 200 crores out of which 115 crores are gold reserves and the remaining reserve of 85 crores must be held in foreign securities. This system is also known as Manage Paper Currency Method.

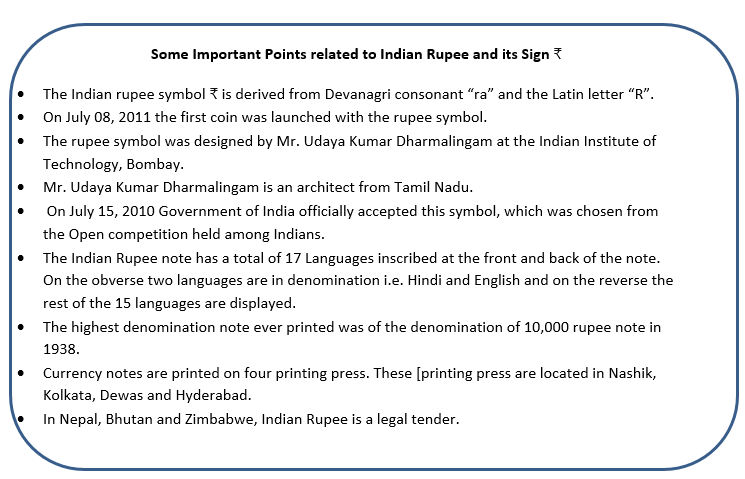

About Indian Rupee and its Sign:

The following are some essential points about the Indian Rupee note and its sign, this can be very useful from an exam point of view.

You can attempt our Free Full-Length Mock tests here

Related Articles:

Get Free Online Test Series, GK updates in form of Beepedia, BeeBooster, as well as latest updates for Bank PO, Bank Clerk, SSC, RBI, NABARD and Other Government Jobs.

займ без паспорта на картувзять займ онлайн на кивизайм без проверок и звонков

![List of Joint Military Exercises of India [2020]](https://ixambee.com/blog/wp-content/uploads/2020/03/Copy-of-Blog-new-11-100x70.png)